Activists and politicians seek more justice for families who are victims of the consolidating companies.

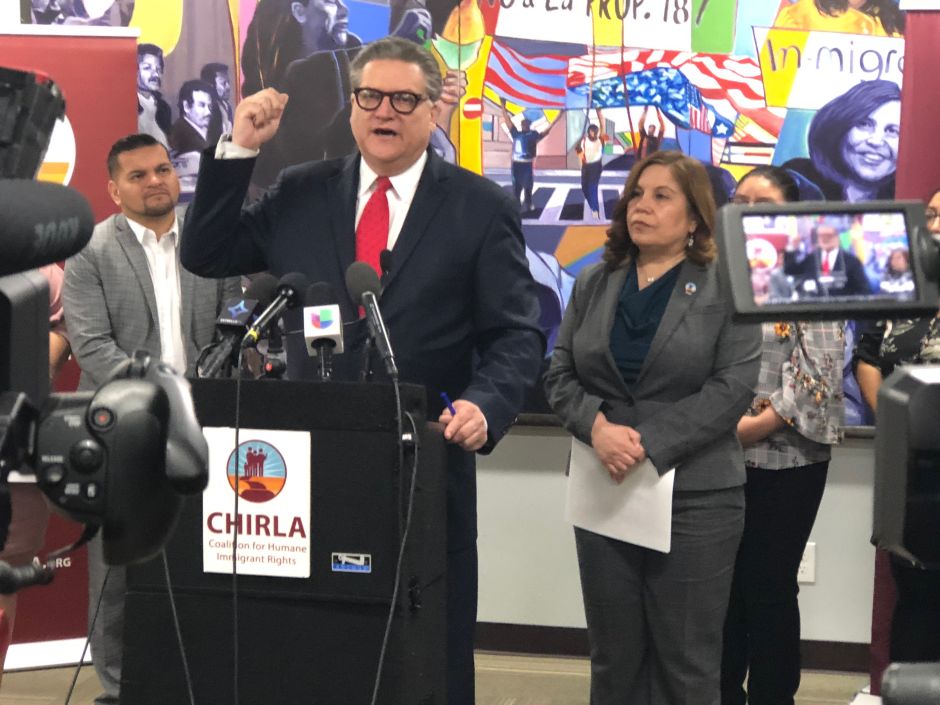

Angélica Salas, director of CHIRLA, presents the Consumer Protection Act in Migration bonds. (Courtesy Tessie Borden / CHIRLA)

Photo:

Tessie Borden / Courtesy

The majority leader in the California Senate, Van Nuys Democratic Sen. Bob Hertzberg, announced a bill, the Consumer Protection Act on Migration Bail Bonds, which seeks to protect immigrants against the abusive bail bond system they are forced to resort to to get out of detention.

“What these bail bonds companies do is indebted families for life. It's amazing! ”Said Hertzberg. “What this initiative will do is give basic protections to immigrants. The same that is given to any consumer ”.

Currently, detained immigrants are forced to sign complex and unfair contracts with commercial consolidators in one of the most stressful moments of their lives, when their freedom or that of a loved one is at stake, and they have no legal representation.

What this measure would do when converted into law is force migrant bail bonds companies to offer a contract in Spanish or the immigrant's language, the possibility of exiting the contract for the first three days, and any other protection offered in California to those requesting a loan such as a home eviction, car or any other good to recover the amount owed.

The bill was presented at the facilities of the Coalition for the Rights of Immigrants (CHIRLA).

Angelica Salas, director of CHIRLA, says immigrants in detention face many challenges. "In this process, they encounter unscrupulous immigration bail companies that take advantage of them at the most vulnerable time of their lives."

Like the migration authorities, he explains that this industry thinks there are no rules for them, and have repeatedly avoided regulations under consumer protection laws.

"This measure will correct a huge mistake, because it will ensure that the law applies to this industry, and that the contracts are in Spanish," said Salas.

And he adds that immigrant families fighting their deportation have too many concerns to also face the predatory practices of companies that do not respect consumer protection laws.

"This year we will end these abuses, and ensure that immigrants have the protections they need in a situation as difficult as deportation," he says.

Diego Cartagena, president and director of the Bet Zedek organization notes that bail bonds companies have operated in the shadows and with very few regulations. "Many of these families of detained immigrants do not have a lawyer, and the bonding contracts are in English, and they cannot read them because they do not understand."

“This proposed law will ensure that consumer protection laws are applied,” emphasizes Cartagena.

Karla Navarrete, a CHIRLA lawyer, explains that many of the immigrants who are granted bail have already been detained for a long time.

“Finally when they are given a bond, they have – for example – to pay $ 20,000. The family can raise $ 5,000, and borrow $ 15,000 from a bond company, ”explains Navarrete. "Apart from that money, they must pay about $ 400 each month for the electronic GPS tracking bracelet that the bonding company puts on them so that they are not supposed to run away."

Navarrete stressed that this puts the community in a very difficult situation because if they don't pay bail, they can be deported faster.

"That's why families rush to contact these bail bonds companies because the alternative is deportation," he says. "And what happens is that they earn or lose the bond, the company will recover the money from the bond, and the immigrant cannot claim anything."