After fighting the debt, the Latino family will only have to pay $ 1,600, but Kaiser Permanente removes it from their health plan.

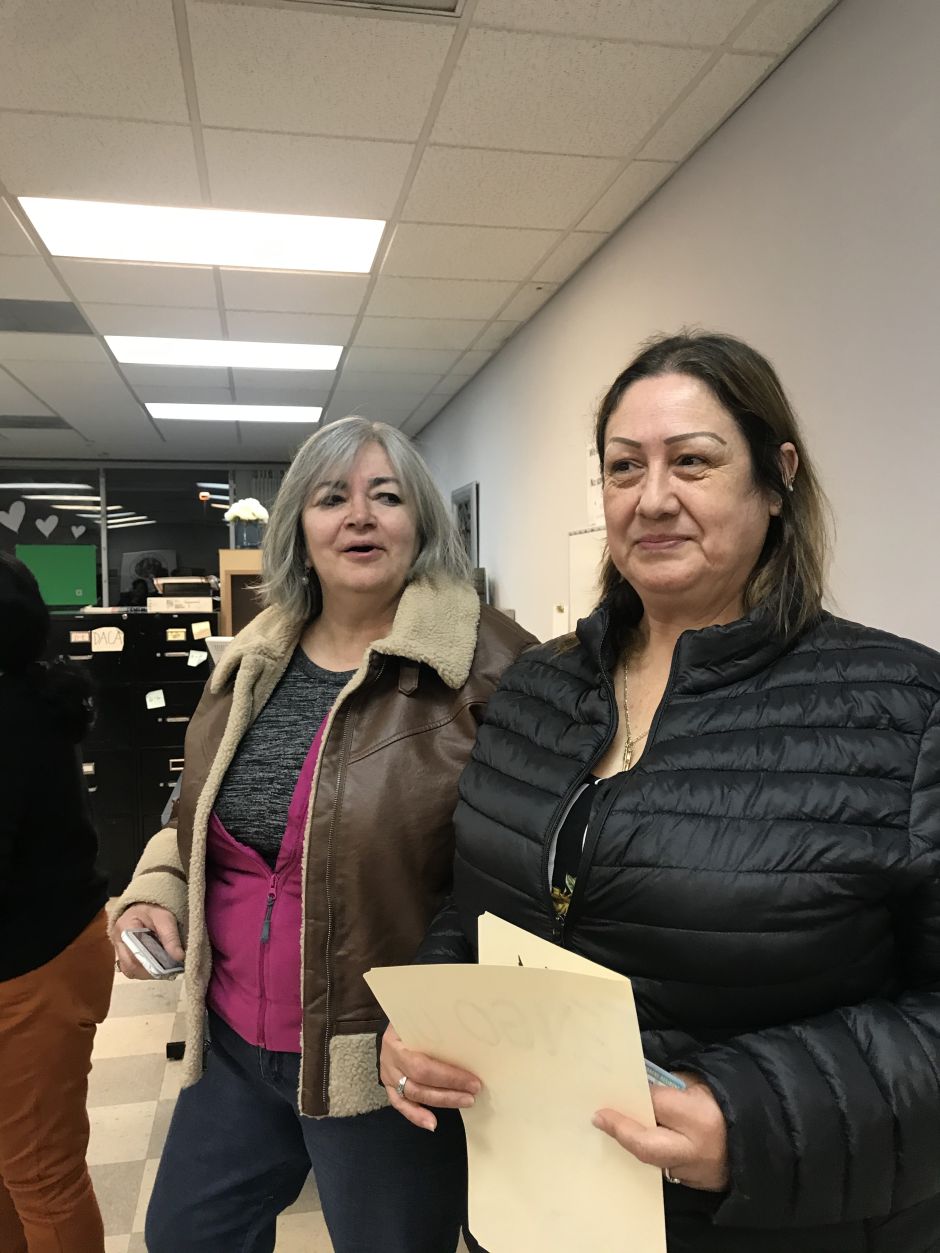

Last year Mrs. Martha Ugarte and her husband José Ugarte were in financial straits after he went to the Kaiser Permanente Hospital emergency room in Panorama City on February 28, 2019.

"He was only hospitalized for three hours," said Martha, 60, recently. "They diagnosed him with stones in the gallbladder.

The doctors prescribed medication to heal him. The couple made a co-payment of $ 240 for José's admission to the hospital.

"As the days went by, we got bigger and bigger bills," Martha said.

His total had exceeded $ 11,000.

"Then they told me that they were going to take me to the collection to pay," said Martha, who is a pro-immigrant activist. "I told them that I was going to sue them for the high charge."

After battling the costs of the three-hour hospitalization, Kaiser Permanente finally managed to reduce the charge to just under $ 1,600. The couple received an invoice in April explaining that the rest had been paid for by "health insurance / adjustments / discounts."

However, this quarrel between the company and the couple left them without health insurance as Kaiser Permanente removed them from their plan.

"Since October we no longer have health insurance," said the activist. "If at first I had been told that the charge was 1,600 I would have paid. But what they were charging me was too much. ”

High price for the service

Yurina Melara, health insurance market spokesperson Covered California said Kaiser Permanente health insurance is among the most expensive on the list, but this has its reasons.

"It is the comfort, for example, of having the pharmacy there and not having to go to other places for what they need," said Melara.

She said that for example a couple under the age of 65 who earns approximately 40,000 a year could obtain health insurance with the Oscar company for $ 244 a month or for $ 362.11 with Kaiser Permanente. Both already with added subsidies.

"With Kaiser, with the Silver plan, you have a co-payment of $ 35, $ 16 for medications and a deductible of $ 7,400," Melara said.

Dr. John Freedman, President and CEO of Freedman Healthcare, said that it is true that in the United States we pay a higher price for doctors, hospitals and medicines than anywhere else in the world.

He explained that approximately 90 cents on the dollar is used to pay doctors, the hospital and pharmaceutical companies and approximately 10 cents go to the companies they use to issue cards and manage risks, contracts and networks, etc.

"And that has led to inflation in health care costs," Freedman said. “That is not primarily the fault of the insurance companies. Insurance companies are simply passing their cost on to us, certainly with a profit margin. ”

Freedman, whose consulting firm is charged with helping to understand health care reform and overall health, said that while many people think health insurance companies take advantage of the client, this is not entirely true. Unless they are private companies.

"For-profit insurance companies may be holding a little more money than they could, but that's not a terrible thing for me," said the doctor. "A real estate agent receives a portion of the sale of the house, but he did a job and was paid for it."

But even in California, there is a cost difference, according to the expert. Northern California premiums tend to be higher than in Southern California. Much of this is because providers there are more expensive.

"That's because you have monopoly providers in the wider San Francisco area that controls many hospitals and doctors' offices by increasing rates, and that's not a problem in Los Angeles," said Freedman. "Southern California generally has more competition."

Losing health insurance is not a good option

For now the lack of access to affordable health insurance has left Martha and José with not very suitable alternatives in terms of time and distance, but for now they consider it to be the best.

"Now we are going to Tijuana to the doctor and to buy the medicine because here (California) even the medicine is more expensive," said Martha, who doubts whether she should re-enroll in a health plan or not.

Yadira López, certified agent of Covered California, said that a person who has had problems with their health insurance due to non-payment can re-enroll in a health plan through the Covered California market, but they can no longer do it with the same company .

"But having health insurance is much better than not having it and the way things are right now, going to Tijuana (for health care) is not a good option," said the agent.

Health insurance for all

Héctor Plascencia, a pro-immigrant activist and health advocate, said that affordable health insurance is needed for everyone, with or without documents. The perfect example is right now in the face of the COVID-19 coronavirus pandemic.

"This time is putting a lot of visibility into what is important and our health is not only for us, but it is also dependent on others", said Plascencia, assuring that there is a lot of work to do and the elections that are coming this year are essential to know What will happen in the future.

"We know that when politics change, the environment that we can create in our nation changes," said the activist. “We have seen the extreme of the bad that can be created when there are changes of power and at the same time we can create the opposite. It is important to have hope and create action. ”

La Opinion tried to contact Kaiser Permanente, but at the end of this edition no response had been received.