In Connecticut, the regulation of rent is primarily governed by CGA §7-148b. This law bans rent control throughout the state, allowing all landlords to set rent and increase it (with proper notice). A tenant is not liable for insufficient funds.

Moreover, What is the new rent law in New York? Notice of Rent Increase

According to the new law, the landlord must give prior notice of 30-days if he/she wants to increase rent by more than 5%. And the period of notice increases with the length of the lease. For example, if the tenant is living for more than a year, a prior notice of 60-days will be valid.

Can new landlord raise rent in CT?

After the end of the 9-month period, or after your lease expires, your rent can only be increased if the increase is “fair and equitable.” In addition, your landlord must give you at least 60 days notice of any proposed rent increase.

Likewise, Can a landlord break a lease in CT? A landlord cannot lockout their tenant. In Connecticut, the only legal way a landlord can remove a tenant is through a court eviction process, called “Summary Process.”

Is Connecticut a landlord friendly state? Connecticut is generally not considered a very landlord-friendly state because tenants have a number of rights and leverage against landlords. However rental prices are high in Connecticut meaning it is often a lucrative investment.

How much can a landlord raise rent in NYC 2022?

NYC Rent Increase Laws for 2022 Specifically, each year the NYC Rent Guideline Board sets a cap on how much a landlord may increase your rent annually. In June of 2022, the board set a 3.25% increase for one-year lease agreements and a 5% increase for a two-year lease agreement.

What should a landlord provide?

Landlord’s responsibilities

A landlord is responsible for: repairs to the structure and exterior of the property, heating and hot water systems, basins, sinks, baths and other sanitaryware. the safety of gas and electrical appliances. the fire safety of furniture and furnishings provided under the tenancy.

Can a landlord refuse to renew a lease in NY?

If the tenant does not accept the renewal offer within the prescribed time, the landlord may refuse to renew the lease and seek to evict the tenant through court proceedings. If the tenant accepts the renewal offer, the landlord has 30 days to return the fully executed lease to the tenant.

What is a good lease term?

One-year leases are by far and large the most popular length for leases. They’re good if you have high-quality tenants and an effective tenant screening process in place. In this case, year-long leases are good because it secures good tenants for a long period of time.

How do you account for a short-term lease?

Accounting for short-term leases Under ASC 842, the “short-term” lease designation can be applied to an entire class of leases rather than on a lease-by-lease basis. By electing this practical expedient, short-term leases do not need to be reported on the balance sheet.

How are leased fees calculated?

Divide the annual rent by the market derived capitalization rate to indicate the leased fee value.

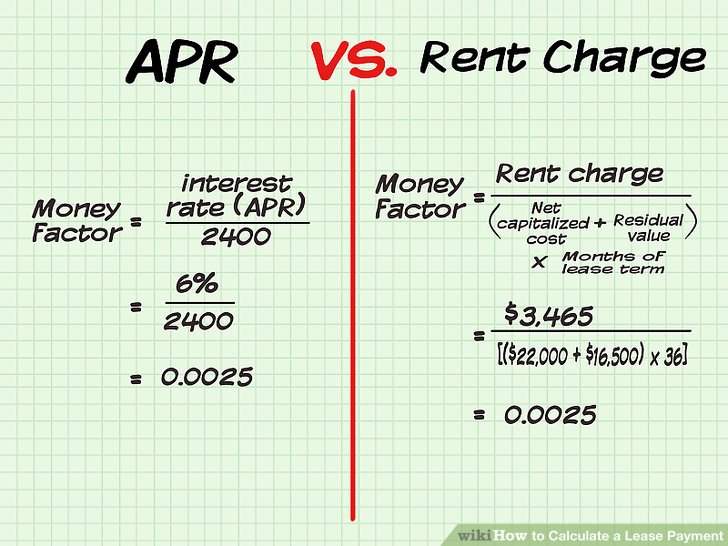

How are lease payments calculated?

Divide the depreciation amount by the number of months in your lease. This will be your base payment. Add the adjusted capitalized cost and the residual value. Take the sum and multiply it by money factor.

Why you should never put money down on a lease?

1. Getting a lower monthly payment: Making a sizable down payment will certainly reduce your monthly lease payments, but it probably won’t save you a ton of money compared to the overall cost of ownership while you lease. That’s because a low money factor means negligible interest charges.

What is short-term lease obligation?

It all starts with determining the lease term on the commencement date of the lease. A short-term lease must have a lease term of 12 months or less determined on the commencement date. Furthermore, it must not contain any purchase options – if it does, it automatically fails the short-term lease definition.

Which lease is for short-term period?

An operating lease is usually characterised by the following features: (i) It is a short-term lease on a period to period basis. The lease period in such a contract is less than the useful life of the asset.

Is lease liability long term or short-term?

The asset and related lease liability are recognized at the present value of the future lease payments and the debt (the lease) is a long-term liability with a short-term component.

Why does rent increase every year?

Landlords may decide to increase their rental prices in order to match market rates, to pay for property maintenance or improvements, to accommodate tax increases, or simply to increase their profits.

Can a landlord raise rent without notice?

For a yearly tenancy, 6 months’ notice must be provided. As we previously explained, a landlord can’t increase the rent during a fixed-term tenancy unless there is a rent review clause set out in the tenancy agreement that says the rent can be increased.

How much notice do landlords have to give for a rent increase?

For tenancies where the rent is paid yearly, the minimum notice period is six months. In all other cases, the minimum notice is equal to the rental period. Once the form has been correctly completed in full, the notice must be served on the tenant.

Can the landlord increase the rent during a fixed term tenancy?

If you have a fixed term agreement Your landlord can’t increase your rent during your fixed term unless you agree or your agreement allows it. If your agreement says your rent can be increased it has to say when and how it will be done. This is known as having a ‘rent review clause’.

Can landlords say no to pets?

A landlord would need a good reason to refuse. For instance, if a home is too small for a pet to be feasible. The government’s new model tenancy agreement is its recommended contract for landlords. But there is no obligation to use it and most landlords don’t.

Why are rents increasing?

Strong rental growth continues to be underpinned by the lack of homes coming onto the market. There are 30% fewer properties available to rent this April than last, while the fall from pre-Covid levels comes in at almost two-thirds (down 61%).

How is rent inflation calculated?

The steps:

- Take the higher new rent and subtract from it the rent amount prior to the increase. Example: $2,062 – $2,000 = $62.

- Divide that monthly dollar difference by the original rent. Example: $62 / $2,000 = . …

- Multiply the numeric increase over the prior rent (it is .

Can a landlord change the locks?

It is illegal for a landlord to change the locks? Yes. The law says that your tenant has the right to quiet enjoyment of their home. However difficult they are being, you must follow the correct legal procedure – which means no changing the locks to keep them out!

What’s the shortest lease you can get?

If you’re looking for a term of 24 months, many car dealerships offer this option. Just be aware that this might be the shortest term available, and you might not be able to get such a short term at all dealerships. Lease programs at dealerships vary by location but generally range from 24 to 60 months.

What is considered a low value lease?

“Low-value” is generally meant to mean US$5,000 or less (note: this is not explicitly stated in the standard, but instead mentioned in the Basis for Conclusions of IFRS 16) The underlying value of the asset is based on the value of the asset when it is new, even if the asset being leased is not new.

Why you should always lease a car?

Benefits of leasing usually include a lower upfront cost, lower monthly payments, and no resale hassle. Benefits of buying usually mean car ownership, complete control over mileage, and a firm idea of costs. Experts generally say that buying a car is a better financial decision for the long term.

What is the lease payment on a 50000 car?

To find out how much of your monthly payment will be interest, add the vehicle’s purchase price to its predicted residual value and then multiply that by the money factor. In the case of our $50,000 car: $50,000 + $30,000 = $80,000. $80,000 x 0.0028 = $224 per month, which is the finance fee.

How long is a short lease?

What is considered to be a ‘short’ lease? Basically, any lease that falls below 80 years is considered to be a short lease. While this may seem like a long time, in terms of leases, 80 years is the cut off point, something commonly referred to as the ’80-year rule’.

How do you account for a short term lease?

Accounting for short-term leases Under ASC 842, the “short-term” lease designation can be applied to an entire class of leases rather than on a lease-by-lease basis. By electing this practical expedient, short-term leases do not need to be reported on the balance sheet.

How do you calculate initial lease liabilities?

A lease liability is the financial obligation for the payments required by a lease, discounted to present value. Under ASC 842, IFRS 16, and GASB 87, the lease liability is calculated as the present value of the remaining lease payments over the lease term.

How do you record a lease?

The company can make the finance lease journal entry by debiting the lease asset account and crediting the lease liability account. In this journal entry, the amount of lease asset or lease liability recorded is the fair value of total lease payments.