- Heads of households earning less than $18,800 (if under 65) and less than $20,500 (if 65 or older) are also exempt.

- If you’re over the age of 65, single and have a gross income of $14,250 or less, you don’t have to pay taxes.

Moreover, What are property taxes based on? Property taxes are calculated using the value of the property. This includes both the land and the buildings on it. Typically, tax assessors will value the property every one to five years and charge the owner-of-record the appropriate rate following the standards set by the taxing authority.

At what age do I stop paying taxes?

Updated For Tax Year 2021 You can stop filing income taxes at age 65 if: You are a senior that is not married and make less than $14,250. You are a senior that is married, and you are going to file jointly and make less than $26,450. You are a qualifying widow, and earned less than $26,450.

Likewise, What is the maximum income to not pay taxes? Earn less than $75,000? You may pay nothing in federal income taxes for 2021. At least half of taxpayers have income under $75,000, according to the most recent data available. The latest round of Covid stimulus checks, as well as more generous tax credits, are the main drivers of lower taxes for some households.

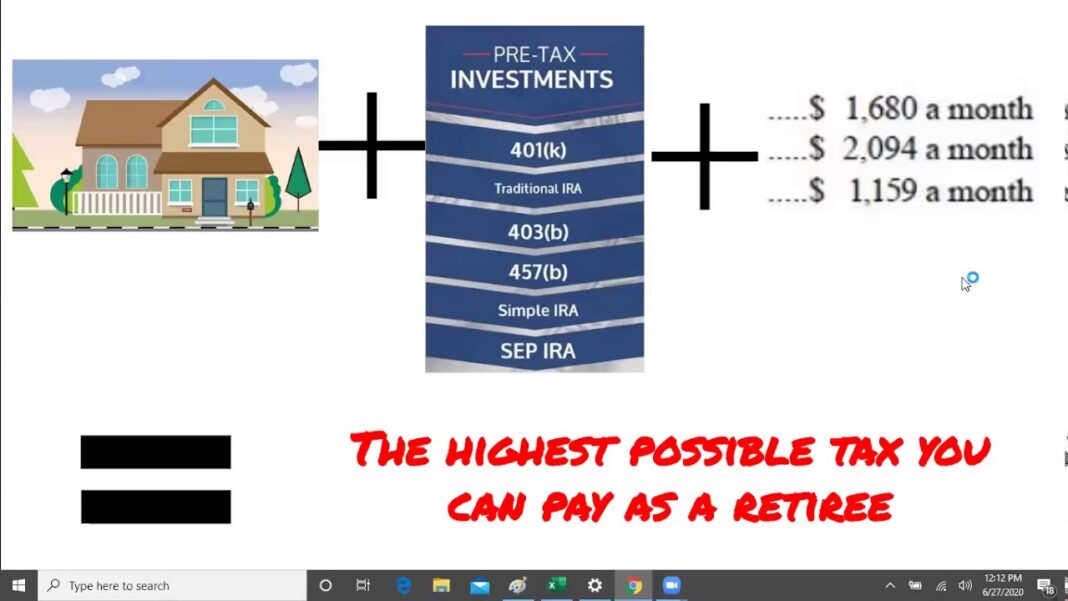

Do retirees pay taxes? Taxes on Pension Income You have to pay income tax on your pension and on withdrawals from any tax-deferred investments—such as traditional IRAs, 401(k)s, 403(b)s and similar retirement plans, and tax-deferred annuities—in the year you take the money. The taxes that are due reduce the amount you have left to spend.

What states have no property tax?

States With No Property Tax 2022

| State | Property Tax Rate | Median Annual Tax |

|---|---|---|

| Alaska | $3,231 | $3,231 |

| New Jersey | $2,530 | $7,840 |

| New Hampshire | $2,296 | $5,388 |

| Texas | $1,993 | $2,775 |

What home expenses are tax deductible?

What expenses can be claimed as a tax deduction?

- Rent of the premises;

- Cost of repairs to the premises; and.

- Any other expenses in connection with the premises. These costs include expenses such as: Interest on a bond; Rates and taxes; Levies; Electricity; Cleaning costs (e.g., domestic worker’s salary); and.

What states have no income tax?

Only seven states have no personal income tax:

- Wyoming.

- Washington.

- Texas.

- South Dakota.

- Nevada.

- Florida.

- Alaska.

Which states have the lowest property taxes?

Hawaii has the lowest effective property tax rate at 0.31%, while New Jersey has the highest at 2.13%.

Is property tax an expense?

Property taxes are an ongoing expense for rental property owners. Homeowners can deduct up to a total of $10,000 ($5,000 if married filing separately) for property taxes and either state and local income taxes or sales taxes.

What state has the highest property tax?

1. New Jersey. New Jersey holds the unenviable distinction of having the highest property taxes in America yet again-it’s a title that the Garden State has gotten used to defending. The tax rate there is an astronomical 2.21%, the highest in the country, and its average home value is painfully high as well.

What is the most tax friendly state?

1. Wyoming. Congratulations, Wyoming – you’re the most tax-friendly state for middle-class families! First, there’s no income tax in Wyoming.

What state has no income tax?

Only seven states have no personal income tax:

- Wyoming.

- Washington.

- Texas.

- South Dakota.

- Nevada.

- Florida.

- Alaska.

How can I lower my property taxes in Kentucky?

Useful Tips on How To Reduce Property Tax Bills

- Avoid any renovations on the property before the assessment.

- Join the assessor during the evaluation to ensure everything is estimated correctly.

- Look for the possible inaccuracies in your tax bill.

- See if you qualify for a Kentucky property tax exemption.

How do I apply for property tax exemption in Kentucky?

The first step in applying for a property tax exemption is to complete the application form (Revenue Form 62A023) and submit it along with all supporting documentation to the property valuation administrator (PVA) of the county in which the property is located.

What is homestead exemption in KY?

Under the Kentucky Constitution, property owners who are 65 or older are eligible to receive the homestead exemption on their primary residence. The homestead exemption is $40,500 for both 2021 and 2022.

How much is property tax in KY?

(July 6, 2021)—The Kentucky Department of Revenue (DOR) has set the 2021 State Real Property Tax Rate at 11.9 cents per $100 of assessed value.

How many acres do you need to be considered a farm in Kentucky?

Under the enabling legislation for the amendment, to qualify as farmland the property had to contain a minimum number of acres (10 acres for agricultural land and 5 acres for horticultural land) and had to be used for agricultural or horticultural purposes.

Do seniors get a property tax break in Kentucky?

Under the Kentucky Constitution, property owners who are 65 or older are eligible to receive the homestead exemption on their primary residence. The homestead exemption is $40,500 for both 2021 and 2022.

What is property tax rate in Kentucky?

(July 6, 2021)—The Kentucky Department of Revenue (DOR) has set the 2021 State Real Property Tax Rate at 11.9 cents per $100 of assessed value.

How can I reduce my property taxes in NJ?

However, there are different ways you might be able to reduce your NJ property taxes.

…

Explore And Apply for NJ Exemptions

- Veterans.

- Seniors.

- People with disabilities.

- Properties used for Agriculture purposes.

At what age do you stop paying property taxes in NJ?

Eligibility Requirements and Income Guidelines You must be age 65 or older, or disabled (with a Physician’s Certificate or Social Security document) as of December 31 of the pretax year.

Who qualifies for NJ property tax relief?

An annual $250 deduction from real property taxes is provided for the dwelling of a qualified senior citizen, disabled person or their surviving spouse. To qualify, you must be age 65 or older, or a permanently and totally disabled individual or the unmarried surviving spouse, age 55 or more, of such person.

Can anyone lower New Jersey property taxes?

Here are the programs that can help you lower property taxes in NJ: $250 veteran property tax deduction. 100% disabled veteran property tax exemption. Active military service property tax deferment.

Can I freeze my property taxes in NJ?

You can still file for the 2021 Senior Freeze. The deadline for 2021 applications is October 31, 2022.

…

2021 Senior Freeze Applications.

| Application filed: | Checks will be issued on or before: |

|---|---|

| June 2 – September 1, 2022 | November 1, 2022 |

What towns in NJ have the highest property taxes?

Here are the 30 N.J. towns with the highest property tax bills

- Millburn. Topping the list yet again is Millburn, with an average property tax bill of $24,485 in 2021, an increase of $115 when compared with the previous year.

- Demarest. …

- Tenafly. …

- Mountain Lakes. …

- Glen Ridge. …

- Rumson. …

- Alpine. …

- Princeton. …

Who qualifies for NJ property tax deduction?

Applicants must be NJ residents for at least 10 years, and living in their current home for the last 5 years; Applicant must meet certain income limits for both the “base year” (year applicant first became eligible) and the application year.