Learn more

[Article partenaire] When you are settled in the United States or preparing to leave, the question of health insurance necessarily arises, and even more so in the midst of the COVID-19 pandemic.

Am I covered in the event of hospitalization? Will there be any costs at my expense? Do I have to advance the costs?

In fact, in France we are used to all health costs being covered without even being informed of the total cost of our care.

However in the United States, a lack of health coverage can turn your American dream into a nightmare!

The American healthcare system

In the United States, there is no social security system covering your health costs as is the case in France. These are mainly private insurance.

In some cases, health coverage can be provided and partially or fully covered by the employer (compulsory for companies with more than 50 employees). The remainder to be paid by the employee may nevertheless represent a substantial sum.

In all other cases, the insured must find cover adapted to his needs according to his budget.

The OBAMACARE (individual Mandate) system, which required residents to take out health coverage with a minimum of guarantees on pain of paying a penalty proportional to their income, has been retained in some states:

These so-called OBAMACARE, or ACA (Afordable Care Act) contracts, are available without any medical selection. However, there is an enrollment period, online or with insurers, outside of which no membership is possible.

These individual contracts can be taken out via what is commonly called the “marketplace” and which is specific to each State.

How to get insurance when you are French?

When you are a foreigner in the USA, several options are possible:

– Either your health insurance is provided by your employer. It can be an Obamacare contract or an expat contract. In this case check that the guarantees are sufficient for your health needs. If they are not, you have the possibility to take out your own contract in addition to the one provided by the employer.

– Either you choose health insurance on the marketplace: Obamacare contracts. This option is used in particular by people who have serious pre-existing pathologies because there is no medical selection. This choice can also be interesting in case of low income since depending on these you may have “subsidies” (state aid) covering part of the cost of your insurance.

– Either you opt for an “expatriate” or IPMI (International Private Medical Insurance) contract. This option is recommended for the majority of French people living abroad because they offer a certain flexibility. “Expatriate” contracts cover you internationally, including in France when you return for a stay, and there is no specific subscription period.

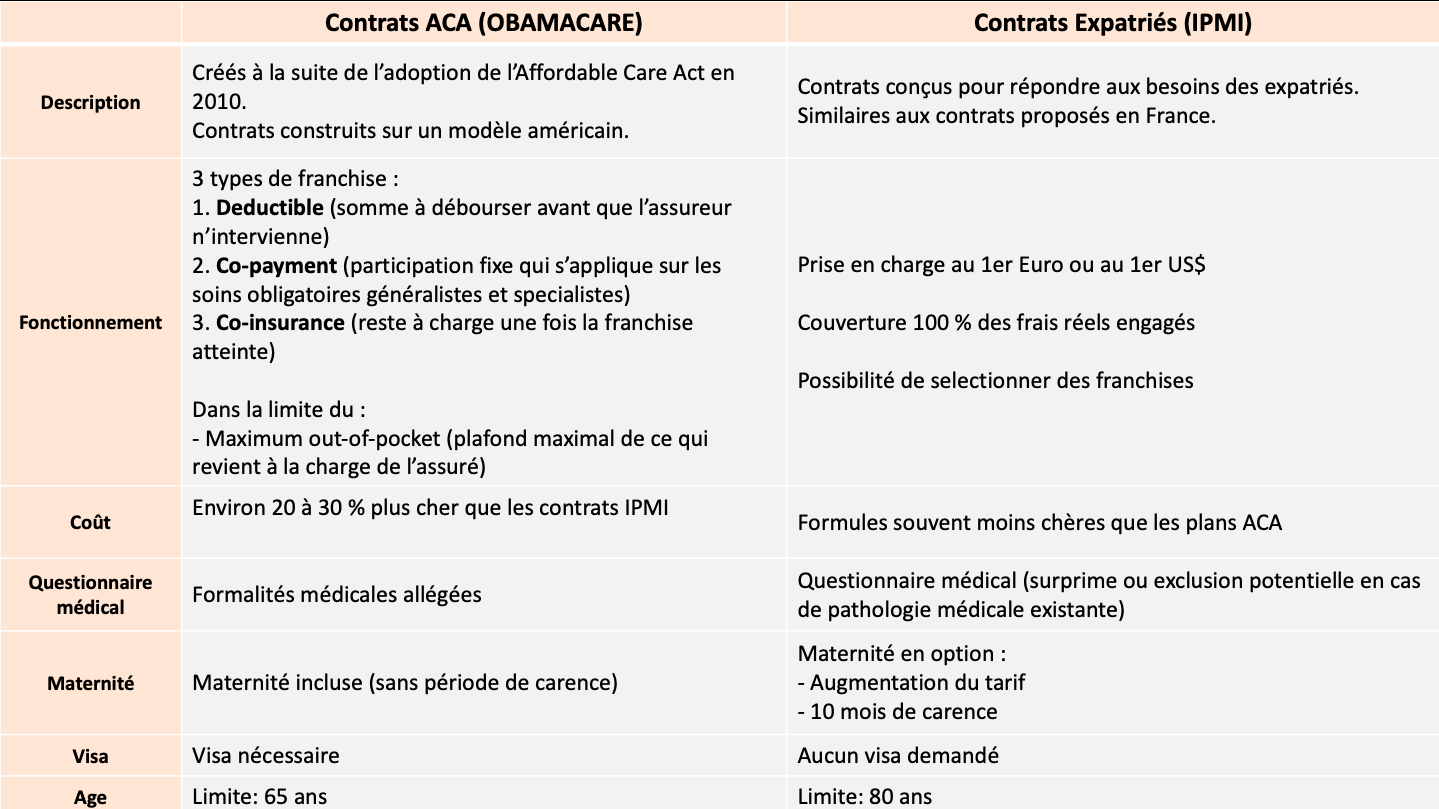

The differences between the “Obamacare” contracts available on the marketplace, and the “expatriate” contracts available from international insurers or brokers such as AGORAEXPAT:

Focus on expatriate contracts (IPMI)

Expatriate contracts are recommended for anyone living abroad. Regarding the United States, expatriate contracts are very often cheaper than contracts available on the Marketplace, and the operation of the contract is much simpler.

These contracts cover you at 100% of the actual costs incurred, without having to advance the costs thanks to the third-party payment. Many IPMI contracts offer you the absolute choice of providers and / or hospitals that you can consult (same reimbursement level whether you consult “in network” or “out of network”).

You can choose a deductible which will allow you to reduce the amount of the contribution, and you can choose to take out the contract in addition to the CFE (Caisse des Français de l’Etranger: organization which allows you to maintain your rights to Social Security French).

Their guarantees apply internationally, that is to say that when you travel outside the United States, or when you return to France, you are covered in the same way.

There are two types of contracts among Expatriate insurance:

– Short-term contracts

– Long-term contracts

Short-term contracts are intended for temporary situations (period of job search, professional mission, travel, studies, etc.) in all other cases and for stays longer than 12 months, long-term contracts are preferred.

Examples of costs:

Tips:

In order to find your way among all the possible health insurance solutions, it is important to first identify your needs in order to be able to check that the guarantees offered are suitable.

It is also important to check the reimbursement limits as well as what will remain at your expense (deductibles, copay, coinsurance, etc.). Also see if you are covered locally or globally. Ask what are the repayment terms (third party payment, online procedures, etc.). And finally, find out about the reputation of the insurance company.

At AgoraExpat, we rigorously select the insurance companies with which we work. They are international insurance experts recognized for their reliability with whom we have negotiated the rates in order to offer you solutions adapted to your budget and your needs.

Our advisers answer all your questions to help you choose the most suitable solution.

OUR ADVISORS ARE AT YOUR SERVICE

France: +33 (0) 9 77 21 99 60 USA: +1 (347) 491-4190

contact@ agoraexpat.com

Request a quote

—————-

Note: “partner articles” are not French Morning editorial articles. They are provided by or written to order from an advertiser who determines their content.

Learn more