- There are several ways that land can be held.

- These include fee simple, cross-lease, unit title and leasehold.

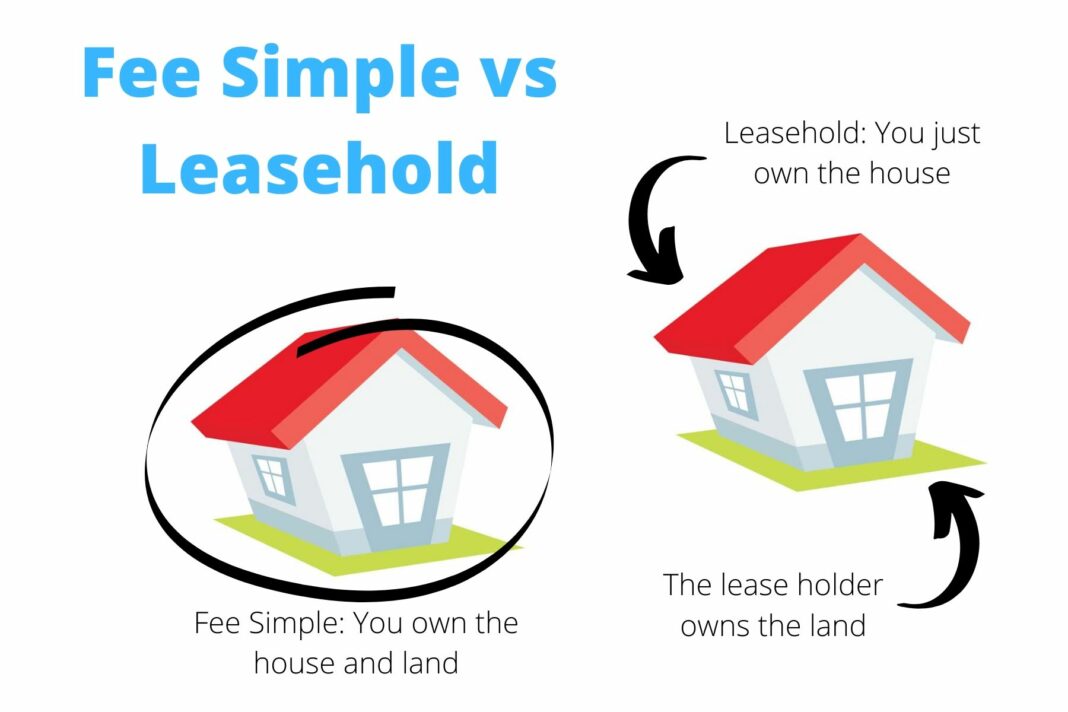

- A fee simple title is where the property is owned freehold and is the most common form of ownership.

- There are no restrictions on this type of ownership.

Moreover, Is fee simple a good thing? As a matter of fact, having a fee simple estate is a good thing when it comes to property ownership. It means you own the property outright, and no one else has claim to it. It’s described by many different sources as the highest form of land ownership in common-law countries.

Why would anyone buy a leasehold property?

Owning a leasehold gives you the right to live in a property for a set period of time, which can be years, decades or centuries.

Likewise, Can I change leasehold to freehold? The process of converting any leasehold to freehold is known as enfranchisement and, in common with other types of enfranchisement, such as collective enfranchisement (click to find out more), how much you’ll pay to convert depends on the result of a RICS freehold valuation, which you have to pay for.

Is leasehold a good investment? If there is great value in a property and you’re able to rent it out over a period of time, with the option to sell it on afterwards without it depreciating substantially in value, then really there’s nothing wrong investing in a leasehold property. There are also a number of perks that come with leaseholds.

Why is it called fee simple?

An interest in land. Land owned in fee simple is owned completely, without any limitations or conditions. This type of unlimited estate is called absolute. A fee simple is generally created when a deed gives the land with no conditions, usually using the words like “to John Doe” or “to John Doe and his heirs”.

What is an example of a fee simple?

For example, if a warranty deed conveys 123 ABC Street for as long as 123 ABC Street is used as a school, then the land would revert back to the grantor when 123 ABC Street is no longer used as a school. This would be a fee simple determinable estate.

What are the two types of fee simple estate?

There are two kinds of Fee Simple: Absolute or Defeasible.

Is it OK to buy a leasehold property?

In summary, it is acceptable to purchase a leasehold home, as long as you are careful with what you are buying. In most cases, the long length of the lease, combined with your legal right to renew your lease, will mean that your interest in the property is satisfactory.

Is it hard to sell a leasehold property?

Selling a leasehold property can be a bit more complicated than selling a freehold property. However, usually you will only need to collect more pieces of paperwork and do some more planning. If you’re properly prepared, selling a leasehold property can be quite straightforward.

Can I renovate a leasehold property?

As a leaseholder there may be restrictions on how and what you can change or alter your leasehold property. If you wish to make significant internal changes to the property, add an extension, or change its use (from residential to commercial), you will have to apply to the freeholder (or landlord) for permission.

What are the disadvantages of buying a leasehold property?

What are the disadvantages of a leasehold property?

- You pay service charges and ground rent to the freeholder, which can increase.

- You need written permission from the freeholder to change the property, and there may be large fees involved.

- You may not be allowed pets.

- You might not be able to run a business from home.

Do leasehold properties increase in value?

The main issue with leasehold is the countdown of the timer – whilst a property usually increases in value as time passes, a leasehold property devalues as the lease goes on, and most people know they can swoop in at a cheap price when the years remaining on the lease are low.

Is it harder to get a mortgage on a leasehold property?

Can I get a mortgage on a leasehold property? Whether or not you can get a mortgage on a leasehold property depends on how long – or short – the lease is. The shorter the lease, the more difficult it is to get a mortgage. Most mortgage lenders won’t lend on properties with a lease under 70 years.

Do banks lend on leasehold?

Mortgage providers often have a lower loan-to-value (LTV) that they’ll lend on leasehold properties. If it’s a new build flat or house, it could be even lower. For example, a provider might offer to lend 90% on a freehold property, but only 85% on a leasehold flat.

Who owns a leasehold property?

You only own a leasehold property for a fixed period of time. You’ll have a legal agreement with the landlord (sometimes known as the ‘freeholder’) called a ‘lease’. This tells you how many years you’ll own the property. Ownership of the property returns to the landlord when the lease comes to an end.

Who pays for repairs on a leasehold property?

You have to pay for any repairs that the lease says are your responsibility. You may also have to contribute to repairs that the freeholder is responsible for. A freeholder’s building insurance may cover all or part of the cost of repairs.

Why you should never buy a leasehold property?

Inflated service charges The managing agent will also charge a percentage fee on top so they have no interest in keeping costs down. Some even take kickbacks from insurance brokers for buying overpriced buildings insurance and passing the cost back to the leaseholders.

Is it wise to buy a leasehold property?

In summary, it is acceptable to purchase a leasehold home, as long as you are careful with what you are buying. In most cases, the long length of the lease, combined with your legal right to renew your lease, will mean that your interest in the property is satisfactory.

Can you sell a leasehold property?

Yes, selling a leasehold property goes beyond answering questions and providing paperwork, you’ll also need to prepare your home for sale the same as any freeholder would. Prospective purchasers are also going to be looking beyond your own living space, too.