- House prices will also decline as affordability constraints bite, but tight markets and a lack of forced sellers means we expect the drop to be relatively modest, with annual growth falling to -5% by mid-2023,” wrote Capital Economics in its latest outlook.

Moreover, Is the housing market going to crash in 2022? This could in turn push average mortgage rates to 3.6% (while still historically low, that is more than double the 1.6% rate recorded at the end of 2021) Based on this data, Capital Economics has forecast house prices to rise throughout 2022, before falling by 5% in 2023.

Will house prices fall when interest rates rise 2022?

“Ultimately, I still expect house prices to continue breaking records through 2022. That said, I do think there is a potential for inflation to recede quite quickly from what is looking like an inflationary peak in late 2022 early 2023,” Law added.

Likewise, Should I buy a house during inflation? In inflationary times, it’s especially important to invest your money in an asset that traditionally holds its value or grows in value. Historically, home price appreciation outperformed inflation in most decades going all the way back to the ’70s, making home ownership a historically strong hedge against inflation.

Is it a buyers or sellers market 2022? What does it all mean for 2022? The property market is expected to remain a buyers’ market for a while yet, as banks continue to compete for customers, meaning they offer better home loan deals. But a slow down of movement in the market has been predicted.

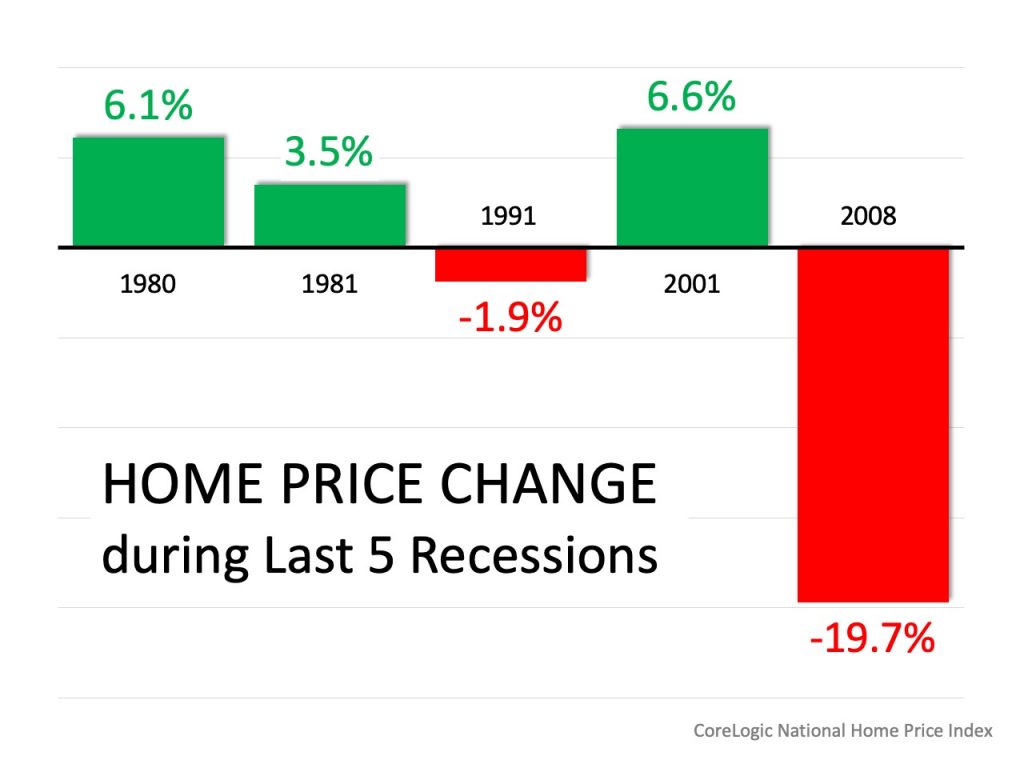

How much did house prices drop in the recession 2008?

After falling 33 percent during the recession, housing prices have returned to peak levels, growing 51 percent since hitting the bottom of the market. The average house price is now 1 percent higher than it was at the peak in 2006, and the average annual equity gain was $14,888 in the third quarter of 2017.

What causes house prices to fall?

The bottom line is that when losses mount, credit standards are tightened, easy mortgage borrowing is no longer available, demand decreases, supply increases, speculators leave the market, and prices fall.

Has the housing market peaked?

The housing market never truly ‘peaks. ‘ “It only warms and cools — and sometimes booms — over time, alternating between a buyer’s and seller’s market. But it always keeps going up.” Put another way, a seller’s market is one positioned in favor of existing homeowners instead of aspiring home buyers.

Is a recession coming in 2022?

Ugly’ inflation numbers make a recession more likely in 2022, economist says. US Federal Reserve Chair Jerome Powell speaks during a news conference at the Federal Reserve Building in Washington, DC, June 15, 2022.

Will there be a recession in 2023?

The U.S. economy will likely tip into recession during the first quarter of 2023 and shrink 0.4% for the full year as the combination of high inflation and tightening monetary policy bedevils consumers and businesses, Fannie Mae economists said.

How should we prepare for a recession in 2022?

Whether a recession is near, or a bit further away, here’s what you can do to prepare.

- Update your resume. The labor market has been hot for job seekers, but that will change if a recession hits. …

- Reduce expenses. …

- Bulk up your emergency fund. …

- Pay down debt. …

- Stay invested.

How long will recession last?

The average recession in the U.S. lasted roughly 17 months. The shortest official recession in U.S history lasted just two months in early 2020. The longest official recession in U.S. history lasted more than five years and occurred from 1873 to 1879, according to the NBER.

Is there a recession coming soon?

“The odds of a recession in the next 18 months are greater than 50%,” Kelly added. Exactly when that downturn might hit is harder to predict, however. Kelly said the economy could slip into a technical recession — defined as two consecutive quarters of negative growth — as soon as the end of the second quarter of 2022.

What should you buy before a recession?

During a recession, some sectors of the economy tend to outperform others as consumer needs shift.

…

Sectors that tend to perform well during recessions

- Communication services.

- Consumer discretionary.

- Consumer staples.

- Energy.

- Financials.

- Health care.

- Industrials.

- Information technology.

How do you get rich in a recession?

Where should I put money in a recession?

To boost your chances of surviving an economic downturn, here are my top 18 recession money rules:

- Build a 12- to 24-month emergency fund. …

- Minimize high-interest debt. …

- Prepare to borrow money. …

- Keep your credit accounts active. …

- If you have low-interest mortgage debt, stay put. …

- Buy in bulk if you can afford to.

Does the recession cause housing to crash?

Although any recession will affect the housing market in some way, this time around it hasn’t caused it to collapse like with the massive defaults on subprime mortgages. In 2021 we saw home prices surge up 20% compared to 2020, despite the strain of the pandemic on many people’s wallet.

Should I sell my house before a recession?

So when is the best time to sell a house? This is where it gets tricky because oftentimes the very best time to sell a house is before a recession. Home values can fall during a recession, but they’re usually at a peak right before the recession hits, so if you can, it’s smart to sell high and buy low.

Are we heading for a recession in 2022?

Kelly said the economy could slip into a technical recession — defined as two consecutive quarters of negative growth — as soon as the end of the second quarter of 2022. Analysts will be closely watching the Bureau of Economic Analysis on July 28 for early estimates on that.