(Partner Article) If you are French non-resident, you are probably already interested in investment in rental real estate because it is the preferred placement of French people abroad. But investing in real estate in France is complicated. Especially if you are looking for a good deal. You want to optimize your return on investment and develop your wealth through the credit lever?

My name is Mickael Zonta, I am a real estate investor and my company has helped more than a hundred expatriates invest in France this year. Discover my professional advice to succeed your projects.

When you are an expatriate, the biggest problems for a real estate project are remoteness and personal contribution. There is therefore a double difficulty which, without good accompaniment, can discourage more than one. For an expatriate, the contribution requested by the banks is often 30% on a rental property investment project. The bank will finance the rest of the operation.

What are the best ways to invest in France when living abroad?

In your wealth strategy, the most important step is to choose the investment device. For an expatriate, there are two interesting ways to invest in rental real estate:

– Invest in performance SCPI : SCPI is a civil real estate investment company. It is a mutual investment. You acquire shares in a park of professional buildings. Everything is managed by the company and you receive your rent normally. The problem of the SCPI is the taxation since it is about land revenue.

– Invest in non-professional furnished leasing LMNP : the interest of investing in LMNP in real life, it is first the taxation which is advantageous thanks to the mechanism of the depreciation and the deficit (depreciation of the good, deduction of the expenses of agency, notary, interest of loan as well as the works which are deductible of your rental income). And it is clearly the corner of blue sky in French taxation today.

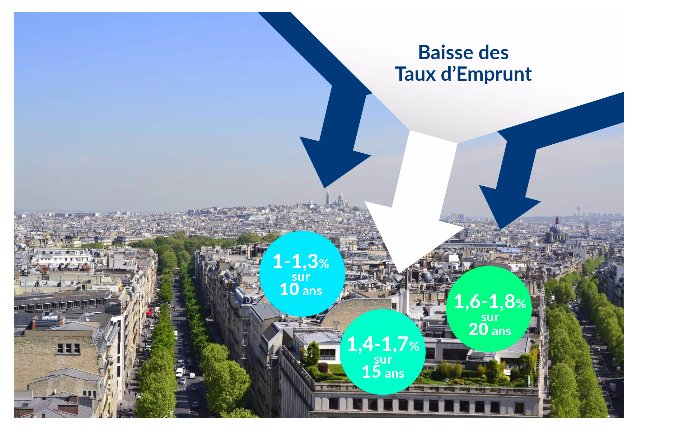

Take advantage of the loan rates, at the very beginning of 2018

After the sharp drop in 2016, rates remained very low in 2017 and the trend should continue at least for the first half of 2018. This rate cut is not limited to loans for people living on French soil. Expatriates also benefit and this increases the financial return of the operation.

Average rates observed for loans granted in December 2017 for non-residents are :

Of 1.00% to 1.30% for a 10-year loan

Of 1.40% to 1.70% for a 15-year loan

Of 1.60% to 1.85% for a loan over 20 years

To get an idea, in 2012, the average borrowing rate for an expatriate was about 3.20% for a 20-year loan. You would have understood it, this rate cut affects your borrowing capacity and therefore on your investment capacity.

To get an idea, in 2012, the average borrowing rate for an expatriate was about 3.20% for a 20-year loan. You would have understood it, this rate cut affects your borrowing capacity and therefore on your investment capacity.

More concretely: in 2012 with a monthly payment of 1.000 € you could borrow 170.000 € over 20 years. Currently, end of 2017 with the same monthly payment of € 1,000, you can borrow € 195,000. A higher investment capacity of € 25,000 !

So there are solutions for expatriate real estate investors that are still very profitable and allow a strong return on investment. If you want to delegate the project while enjoying a high rental yield, you must rely on a trusted partner. This is the challenge our partner is facing. Contact the company Rental Investment to take stock of your project.

2017 balance sheet and 2018 outlook

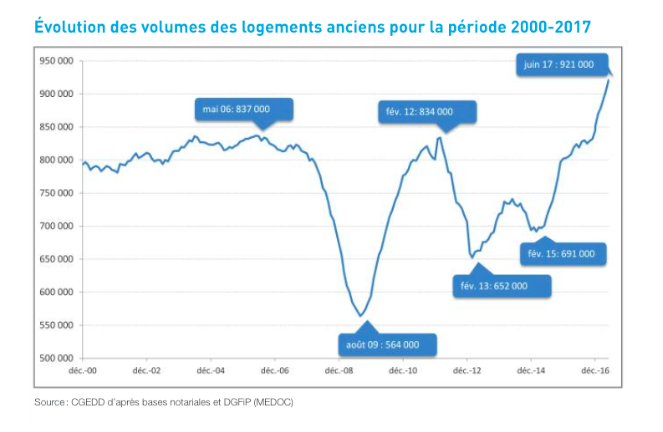

The year 2017 has been very dynamic for real estate.

In 2016, the number of transactions had already been a record exceeding 840,000 in real estate. In 2017, the first figures announce 950,000 real estate transactions in the former. That's an increase of 15% over a year 2016 already announced as a record since.

And as each time the demand increases, prices are under pressure. They climbed an average of 4% throughout the country, 7.8% in Paris and 7.3% in Lyon. If you had invested in 2016, your wealth has already increased.

And as each time the demand increases, prices are under pressure. They climbed an average of 4% throughout the country, 7.8% in Paris and 7.3% in Lyon. If you had invested in 2016, your wealth has already increased.

For now, the rates are stable and remain below 2%. So the first half of 2018 should be as dynamic as 2017. The cancellation of the rent control in Paris (at the end of November 2017) is a good signal for the market in Paris where rental demand remains very strong.

2018 seems like an ideal year if you want to start a new real estate project in France.

Investissement-locatif.com is a company that accompanies expatriates in their real estate rental investment projects. It's also a turnkey solution for those who are not there to manage, who do not know, or who want to benefit from the best returns in the market: up to 6.50% in intramural Paris and 10% in Ile de France, all costs included. More than half of the company's customers carry out several projects, which is a guarantee of quality.

Take a free update on your project during an appointment exchange (free).

Check out the latest video testimonial

Download the free Expatriate Investor's Guide:

![[Vidéo] Real estate: buying in New York in 2021](https://californialines.com/wp-content/uploads/2021/01/Video-Real-estate-buying-in-New-York-in-2021-218x150.jpg)