- 2022 is still a seller’s market if you’re looking to take advantage – but it’s important to note that the market is not as competitive as it was in 2021.

- You may have heard stories about sellers able to find buyers to take their home as-is, or in some cases, even without an inspection in 2021.

Moreover, What is the best month to sell a house? Nationally, the best time to sell a house is March if you’re trying to sell quickly, while the best time to maximize profit is July. Zillow recommends listing your home for sale in March, but no later than Labor Day, based on historical market trends.

Will house prices go down in 2023?

House prices will also decline as affordability constraints bite, but tight markets and a lack of forced sellers means we expect the drop to be relatively modest, with annual growth falling to -5% by mid-2023,” wrote Capital Economics in its latest outlook.

Likewise, Is it a buyers or sellers market 2022? What does it all mean for 2022? The property market is expected to remain a buyers’ market for a while yet, as banks continue to compete for customers, meaning they offer better home loan deals. But a slow down of movement in the market has been predicted.

Can I sell my house and still live in it? With a home reversion scheme, you sell all or part of your home in return for a cash lump sum, a regular income, or both. Your home, or the part of it you sell, now belongs to someone else. However, you’re allowed to carry on living in it until you die or move out, paying no rent.

What’s the worst time of year to sell a house?

The worst month of the year to sell a house is December, which ties with October at a 5.8 percent seller premium, according to ATTOM. Homebuying activity typically comes to a near-standstill in December, when people tend to travel and are busy with holiday events.

What is the slowest month for real estate sales?

Lowest Home Prices Are Typically in January Median sales prices are more affordable between October and February compared to other months of the year. For example, January 2021 had sales prices listed at $329,242, which peaked at $385,546 in June 2021.

How long does average house sale take?

It now takes an average of 295 days to sell a home Looking at the total time to sell from the initial listing of a property to the sale being recorded by the Land Registry as complete, the research shows it’s now taking an average of 295 days to sell a home.

Is it a good time to sell a house 2022?

House price growth has been ongoing during the pandemic, and it shows no signs of slowing anytime soon. For this reason, 2022 could be a great time to sell your home. In fact, it may be wise to sell before house prices inevitably drop, interest rates rise or buyer demand wanes.

What makes a house unsellable?

Factors that make a home unsellable “are the ones that cannot be changed: location, low ceilings, difficult floor plan that cannot be easily modified, poor architecture,” Robin Kencel of The Robin Kencel Group at Compass in Connecticut, who sells homes between $500,000 and $28 million, told Business Insider.

What will happen to house prices in 2022?

“While most people predicted that house price growth would slow as we moved into 2022, I forecasted at the end of 2020 that we would see strong growth not just in 2021, but also in 2022, with both years likely to see increases in house prices at 8-10% higher for new builds,” said Stuart Law (pictured), chief executive …

What is the most common reason a home fails to sell?

The most common reason a property fails to sell is an unreasonable asking price by the seller. An asking price that’s too high is the surest way to increase your days on market and have a “non-starter” listing that buyers simply ignore.

What increases home value?

Making your house more efficient, adding square footage, upgrading the kitchen or bath and installing smart-home technology can help increase its value.

Is it normal to feel sad when selling your house?

Working through your feelings early will make the selling process smoother, but even if you spent time grieving before putting your home on the market, it’s still normal to feel some pangs of sadness during closing. While it’s easy to tell yourself you’re overreacting, getting past remorse isn’t a simple process.

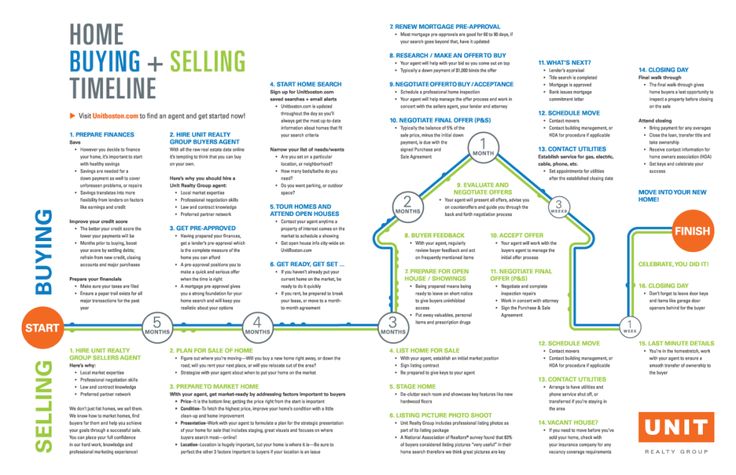

What are the stages of selling and buying a house?

- Work out your finances. …

- Get your EPC. …

- Dig out these key documents. …

- Prepare your home for sale. …

- Find an estate agent & market the property. …

- Start your house hunt. …

- Check your finances & make an offer. …

- Formalise your mortgage.

How do you emotionally let go of your house?

Tips to Emotionally Detach From Your Home for an Easier Sale

- Don’t Let Your Emotions Can Get in the Way of Your Sale. …

- Are You Ready? …

- Think of Your House as a Product. …

- Use Your Emotions to Your Favor. …

- Don’t Forget About the Non-Physical Aspects of Selling a House. …

- Stage Your Home, It Helps. …

- Selling is not Forgetting.

How do you say goodbye to your house?

5 Ways to Say Farewell to Your Home Before You Move

- Make Your Mark. Many people grieve leaving their house because they hate the thought of it going on without them. …

- Take Photographs. …

- Take Something With You When You Go. …

- Have a House Cooling Party. …

- Write a Letter to the New Owners.

Do people regret selling their house?

It’s not uncommon for sellers to experience regret after selling their home. In fact, a study by the National Association of Realtors found that nearly one-third of sellers regretted their decision to sell.

Can you put an offer on a house before selling yours?

So, can you put an offer on a house before selling your own? The simple answer is yes, you can offer on a house before selling your own.

Is it better to sell your house before buying another?

Selling first is beneficial if you need to access your current home equity to buy your new home. However, selling first often requires temporary housing while buying your new house. From a real estate market standpoint, selling before buying makes the most sense for people who are selling in a buyers market.

What is the 2 out of 5 year rule?

During the 5 years before you sell your home, you must have at least: 2 years of ownership and. 2 years of use as a primary residence.

How long do you have to buy another house to avoid capital gains?

You do not need to make a direct swap in a like-kind exchange. Instead, once you sell your first investment property you can put the proceeds from this sale (your capital gains profits) into escrow. You then have 180 days to find and purchase another similarly situated piece of land.

How do I avoid capital gains tax on property sale?

Reinvesting in property: 3 ways to avoid Long-Term Capital Gains…

- LTCG tax on purchase of house. According to the provisions of the Income Tax Act, any profit earned from the sale of an asset is termed as capital gains and is taxable. …

- Sale of house. …

- Sale of other long-term assets. …

- Set-off provision. …

- Riders.

How much tax do you pay when you sell a house?

Capital gains tax on residential property may be 18% or 28% of the gain (not the total sale price). Usually, when you sell your main home (or only home) you don’t have to pay any capital gains tax (CGT). However, in some circumstances you may have to pay some.

Is money from the sale of a house considered income?

Home sales profits are considered capital gains, taxed at federal rates of 0%, 15% or 20% in 2021, depending on income. The IRS offers a write-off for homeowners, allowing single filers to exclude up to $250,000 of profit and married couples filing together can subtract up to $500,000.

What do you do with your money when you sell your house?

Where Is the Best Place to Put Your Money After Selling a House?

- Put It in a Savings Account. …

- Pay Down Debt. …

- Increase Your Stock Portfolio. …

- Invest in Real Estate. …

- Supplement Your Retirement with Annuities. …

- Acquire Permanent Life Insurance. …

- Purchase Long-term Care Insurance.

What is the capital gains exemption for 2021?

If you have a capital gain from the sale of your main home, you may qualify to exclude up to $250,000 of that gain from your income, or up to $500,000 of that gain if you file a joint return with your spouse.

Do I have to pay capital gains tax immediately?

You don’t have to pay capital gains tax until you sell your investment. The tax paid covers the amount of profit — the capital gain — you made between the purchase price and sale price of the stock, real estate or other asset.