- Is Swapalease Legit?

- Yes, Swapalease is a legitimate company.

- It has been an Accredited Business with the Better Business Bureau since 2001.

- The business began in 1997.

Moreover, Are apartment lease takeovers a good idea? But your best bet may be a lease takeover, if your landlord permits it and you can find a qualified tenant. And if you’re a renter looking for a short-term option, taking over someone’s lease can be an excellent way to take advantage of lower rental rates.

Can you get scammed on swapalease?

Often these non-legitimate, or scam, emails impersonate a reputable company such as Swapalease.com by illegally displaying a company’s name, logo, and/or trademark. The intent is to deceive customers into revealing information such as: Username and/or Password. Social security number.

Likewise, Does swap a lease affect your credit? You’ll have to pay a transfer fee, but your credit will not be impacted. Lease trading like Swapalease.com, LeaseTrade.com and LeaseTrader.com serve as an intermediary between lease holders who want to get out of their lease and people interested in taking over a lease.

Can you negotiate on swapalease? Your lease assumption is absolutely negotiable, but you need to understand what is and is not negotiable. Negotiating with the Seller is easy to do and can be done through e-mail if you are uncomfortable negotiating over the phone or in person.

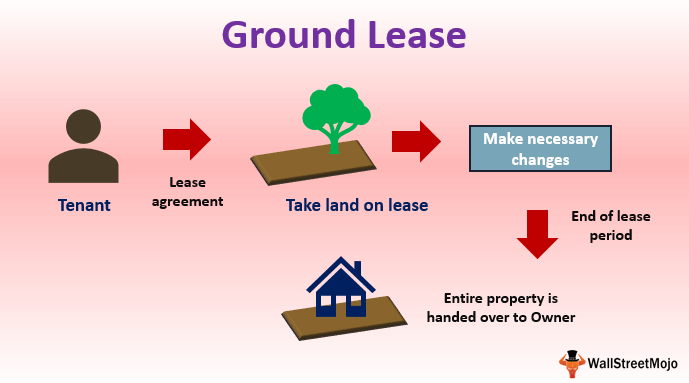

What is the difference between leasing and subleasing?

The lease states the length of time the contract is to run and the amount of the tenant’s rent. In legal terms, the tenant’s legal right to possess the property is deemed tenancy. Subleasing occurs when the tenant transfers a part of their legal tenancy to a third party as a new tenant.

Can I sublease my apartment?

In general, if your lease doesn’t mention subleasing, it is usually permitted. However, most leases do require that you obtain your landlord’s consent to sublease as well as your landlord’s approval of any new subtenant.

Is sublease legal?

Yes, provided he is not restricted to do so by the Contract of Lease. The law says: “When in the contract of lease of things there is no express prohibition, the lessee may sublet the thing leased, in whole or in part, without prejudice to his responsibility for the performance of the contract toward the lessor.”

Is assuming a car lease a good idea?

Is a lease takeover a good idea? Depending on your circumstances, taking over someone else’s car lease can be a smart move because a lease could come with lower monthly costs and expanded vehicle options compared to buying.

Does lease transfer affect credit?

Find a new owner to take over your lease, if your contract permits transferring. You’ll have to pay a transfer fee, but your credit will not be impacted.

Can someone else lease a car for me?

A. Yes! If you are a parent or a partner etc and you would like others to be able to drive this is fine as long as the leaseholder is the main driver on the insurance. Provided they are fully insured there won’t be a problem.

What is the lease payment on a 50000 car?

To find out how much of your monthly payment will be interest, add the vehicle’s purchase price to its predicted residual value and then multiply that by the money factor. In the case of our $50,000 car: $50,000 + $30,000 = $80,000. $80,000 x 0.0028 = $224 per month, which is the finance fee.

Why you should always lease a car?

Benefits of leasing usually include a lower upfront cost, lower monthly payments, and no resale hassle. Benefits of buying usually mean car ownership, complete control over mileage, and a firm idea of costs. Experts generally say that buying a car is a better financial decision for the long term.

Does a lease affect your credit?

Whether you lease or buy, a new vehicle can impact your credit score. With a lease, you have a monthly payment obligation. When the lease ends, there’s likely to be either a new lease or a new monthly cost for a vehicle purchase. In either case, credit utilization is increased, and that can reduce your credit score.

Is it better to lease or finance a car?

The monthly payments on a lease are usually lower than monthly finance payments if you bought the same car. With a lease, you’re paying to drive the car, not to buy it. That means you’re paying for the car’s expected depreciation — or loss of value — during the lease period, plus a rent charge, taxes, and fees.

What is the lease payment on a $30000 car?

Your budget on that $30,000 car is $300.00 monthly. In reality, it rarely pays off to put any additional money down on a car lease in order to reduce your monthly payment. Look at your average car payment – and you’ll do much better at the negotiating table.

Why you should never put money down on a lease?

1. Getting a lower monthly payment: Making a sizable down payment will certainly reduce your monthly lease payments, but it probably won’t save you a ton of money compared to the overall cost of ownership while you lease. That’s because a low money factor means negligible interest charges.

Is a 15000 mile lease worth it?

A high-mileage lease allows you to drive more than the 10,000 to 15,000 miles you’re typically allotted when you lease a car. That can mean a higher monthly payment — but it may be worth it. The fees you’d pay for exceeding your lease’s mileage cap could cost a lot more.

What happens after car lease ends?

You’ll be expected to make a small down payment, followed by monthly payments for the remainder of your car lease term. Once your lease term expires, you must return the car to the dealership, where you may choose to extend the lease or trade in your current car for a newer ride.

Why leasing a car is smart?

Some of the benefits of leasing include lower monthly payments, the ability to get a new car every few years, no resale hassle, and tax deductions. Experts generally say that buying a car is a better financial decision for the long term.

Do leases affect your credit score?

Whether you lease or buy, a new vehicle can impact your credit score. With a lease, you have a monthly payment obligation. When the lease ends, there’s likely to be either a new lease or a new monthly cost for a vehicle purchase. In either case, credit utilization is increased, and that can reduce your credit score.

Is it better to lease or finance?

The monthly payments on a lease are usually lower than monthly finance payments if you bought the same car. With a lease, you’re paying to drive the car, not to buy it. That means you’re paying for the car’s expected depreciation — or loss of value — during the lease period, plus a rent charge, taxes, and fees.

What are disadvantages of leasing a car?

8 Biggest Disadvantages to Leasing a Car

- Expensive in the Long Run. …

- Limited Mileage. …

- High Insurance Cost. …

- Confusing. …

- Hard to Cancel. …

- Requires Good Credit. …

- Lots of Fees. …

- No Customizations.