- Buying raw land is a very risky investment because it will not generate any income and may not generate a capital gain when the property is sold.

- Moreover, utilizing a farm real estate loan to purchase land is very risky.

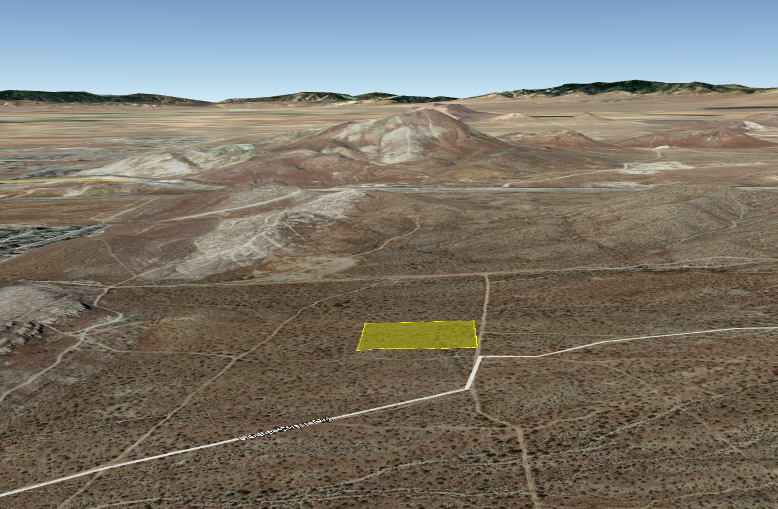

Moreover, Is vacant land a good investment? Buy Raw Land or Vacant Land to Diversify Your Net Worth Investing in land, no matter if it is raw land with zero development, is one of the best methods to diversify your net worth. You can build anything on the land purchased. This can be a personal property or any commercial real estate.

Is owning land a tax write off?

Yes, you can only write off the taxes. Any money you pay for land improvements are added to the basis of the land (price you paid for it) to reduce the capital gains on your land when you dispose of it.

Likewise, Does land ever lose value? Land, like any asset, can go down in value, but it doesn’t depreciate in the accounting sense. This is important to businesses, because the depreciation of assets is tax-deductible as a business expense.

Is it smart to buy land now? A piece of land remains in good condition and increases in value. Owning land gives you financial security and peace of mind. Experts recommend raw land investing and buying land for future development, such as housing or building. No maintenance is required, and you can sell your land at a higher price in the future.

How can land pay for itself?

How to Make Money with Your Land Quickly

- Host a Billboard. If your vacant land borders a busy road, having a billboard could put a substantial amount of money in your pocket. …

- Harvest Timber. …

- Provide Storage. …

- Open a Campground. …

- Offer to Rent Your Land as Pasture. …

- Host Bees. …

- Lease Land to Hunters. …

- Allow Farmers to Lease Land.

What are the benefits of owning land?

Some of the benefits of owning land include the following:

- No Maintenance. When you invest in vacant land, there is literally no maintenance that needs to be done to the area. …

- Hands-Off. …

- Lack Of Competition. …

- Little Startup Funds. …

- Fast-Paced Opportunity. …

- Run Your Business Remotely.

Can land be expensed?

Tax Treatment of Property Taxes Expenses from land are itemized and go on Schedule E. These expenses can offset income on other investment properties. While a land investment is not directly tax deductible, expenses incurred from the investment are tax deductible.

How can I avoid capital gains tax on land sale?

How to Avoid Capital Gains Taxes on a Land Sale

- A financial advisor can help you optimize a tax strategy for your investment needs and goals.

- What Are Capital Gains Taxes?

- 1031 exchange. …

- Deferred sale. …

- Installment sale. …

- Offset gains with capital losses. …

- Donate appreciated land to a charity.

What can you build on land without planning permission?

What changes can I make without planning permission?

- 12 square metres for terraced or semi-detached houses.

- 20 square metres for detached houses.

Can I live on my own land without planning permission?

No. “It is not an offence to carry out development without first obtaining any planning permission required for it” ( PPG18 Para 6). It will normally* only become illegal for you to be living on the land when an enforcement notice against you comes into effect.

What is the 4 year rule in planning permission?

The ‘4 Year Rule’ allows you to make a formal application for a certificate to determine whether your unauthorised use or development can become lawful through the passage of time — rather than compliance with space standards — and can continue without the need for planning permission.

Do I need planning permission to build on my own land?

Planning permission for self-build either comes with the plot or can be applied for before or after land purchase. Planning permission is associated with the land, rather than the applicant and you can make a purchase subject to planning permission. Some agreements of this nature can incur legal fees.

Is it smart to purchase land?

Buying raw land is a very risky investment because it will not generate any income and may not generate a capital gain when the property is sold. Moreover, utilizing a farm real estate loan to purchase land is very risky.

Is it better to invest in land or house?

The land would yield better returns than property. A large initial capital must be invested to buy a property and this may turn into a bad investment if you would not generate good returns. However, capital investment in land is lower in comparison to property.

What can I do with 5 acres to make money?

Grow and Sell High-Value Crops

- Microgreens. Microgreens are a popular choice of farmers as they take up little space, have a quick turnaround, and have high cash value. …

- Mushrooms. Growing mushrooms can be a very profitable business. …

- Bamboo. …

- Ginseng. …

- Garlic. …

- Broiler Chickens. …

- Quail.

How can I make money with 10 acres of land?

How To Make Money On 10 Acres: 81 Creative Ways To Kick-Start Your Earnings

- How To Make Money On 10 Acres: Grow Small Acreage Crops. …

- Raise Animals For Food. …

- Sell Your Own Products From Your Plants or Animals. …

- Set Up Structures or Rent Out The Land. …

- Create Classes To Teach People About The Outdoors.

What can be done in 2 acres of land?

If you don’t have any other work and want to work in your own land, then go for cultivation. If sufficient water is available ,you may go for long term crops such as paddy,sugarcane,cereals and if water is limited,then go for growing vegetables with drip irrigation.

Is buying land in Texas a good investment?

Getting the money to buy land in Texas is a hurdle for many. The good news is that land in Texas is quite affordable. Rates from one area to another vary, but broadly speaking, buying land is a viable investment that is much more affordable than buying or constructing commercial buildings.

Is there free land in Texas?

No state actually gives out free land, but there are cities that are offering free land. Most of these cities are located in the following states: Kansas, Nebraska, Minnesota, Colorado, Iowa and Texas.

How do people afford land in Texas?

Here are three of our tips for how to buy land in Texas.

- Hustle to save as much as possible. Let’s face it. …

- Improve your credit score. There are a bunch of tips for building great credit, but our favorite approach is simple. …

- Look for alternative lending sources. …

- Find your Owner Financed Land at Texas Acres.

What is the average price for an acre of land in Texas?

Overall the average rural land price per acre in Texas in 2021 was about $3,725, up a massive 25% over 2020’s overall average of $3,064. The 2020 average was an understandably modest 3% increase from the 2019 average of $2,972.

What is the prettiest city in Texas?

Architectural Digest Just Chose the Prettiest Town in Texas: Do You Agree? Architectural Digest recently listed Fredericksburg as the prettiest town in Texas. The Lone Star State has something over 3,300 cities and towns (including unincorporated areas), so for Fredericksburg to stand out, it must be truly special.

Is it illegal to live off the grid in Texas?

Is Off Grid Living Legal in Texas? Like with virtually all other states, there are no Texas state laws that prohibit off grid living. However, there are local laws that prohibit off grid systems. These laws mostly have to do with zoning ordinances.

How do I claim abandoned property in Texas?

Use the “Claim It Texas” website to search for unclaimed property or report abandoned property as required by law. This nationwide database of unclaimed property is endorsed by the National Association of Unclaimed Property Administrators and many participating states, including Texas.