- There are several ways that land can be held.

- These include fee simple, cross-lease, unit title and leasehold.

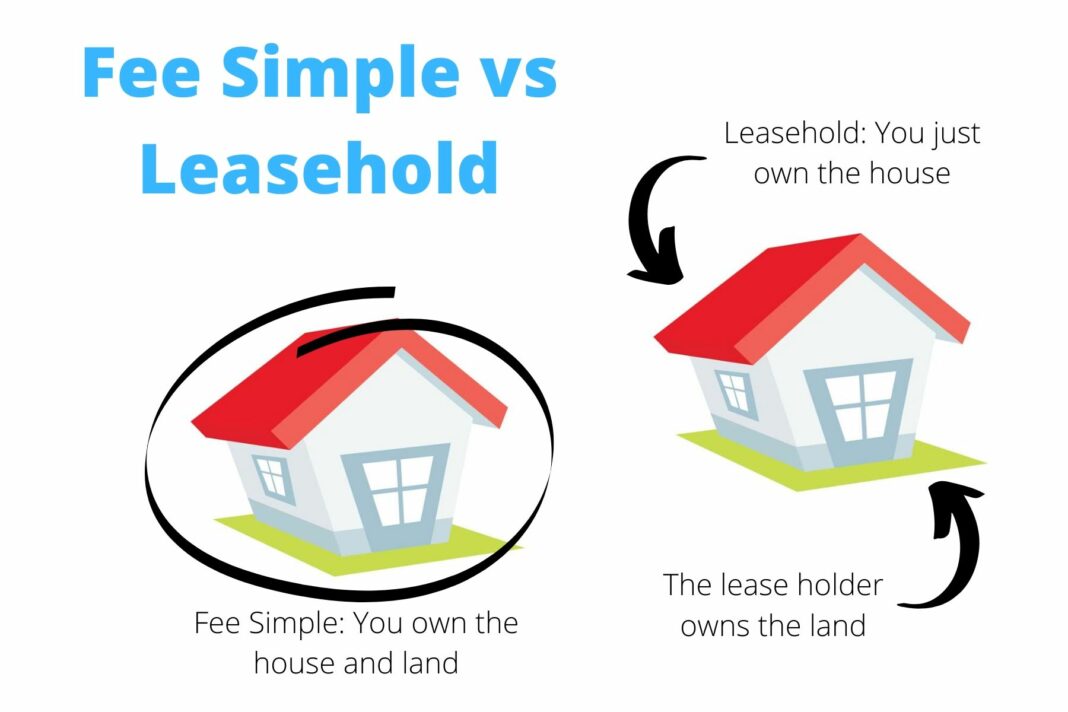

- A fee simple title is where the property is owned freehold and is the most common form of ownership.

- There are no restrictions on this type of ownership.

Moreover, What leasehold means? Leasehold property is a property interest for a fixed period of time (usually 99 years). But you do not own the property outright (unlike freehold – which grants you ownership of the building and the land it stands on). As a leaseholder, you can use the property for the duration of the fixed term of the lease.

Why would anyone buy a leasehold property?

Owning a leasehold gives you the right to live in a property for a set period of time, which can be years, decades or centuries.

Likewise, Can I change leasehold to freehold? The process of converting any leasehold to freehold is known as enfranchisement and, in common with other types of enfranchisement, such as collective enfranchisement (click to find out more), how much you’ll pay to convert depends on the result of a RICS freehold valuation, which you have to pay for.

Can you sell a leasehold property? Yes, selling a leasehold property goes beyond answering questions and providing paperwork, you’ll also need to prepare your home for sale the same as any freeholder would. Prospective purchasers are also going to be looking beyond your own living space, too.

Should you avoid leasehold?

In summary, it is acceptable to purchase a leasehold home, as long as you are careful with what you are buying. In most cases, the long length of the lease, combined with your legal right to renew your lease, will mean that your interest in the property is satisfactory.

Can you sell leasehold property?

When you sell a leasehold property, the lease is transferred to the new leaseholder. So, they will have to adhere to everything that was agreed to in the original contract, including paying the ground rent and service charge. The general process for selling a leasehold property is similar to freehold.

Who pays the lease preparation fee?

This party may be either the landlord or the tenant, or the costs may be apportioned between them by agreement. Where this type of approach may vary is upon the renewal of the lease. Either party may insist that the other party pay for the costs associated with the negotiation and formalities for renewal.

Does tenant pay for lease fee?

While there is no law as to how much a rental agency or landlord can charge for a lease agreement, section 5(3)(p) of the Rental Housing Act stipulates “any costs in relation to contract of lease shall only be payable by the tenant upon proof of factual expenditure by the landlord.”

What fees can you charge a tenant?

This means London renters will save over £600 on average each time they move home.

…

You can still be charged for:

- the rent.

- a refundable tenancy deposit capped at no more than five weeks’ rent.

- a refundable holding deposit (to reserve a property) capped at no more than one week’s rent.

Are lease renewal fees allowable?

The normal legal and professional fees incurred on the renewal of a lease are also allowable if the lease is for less than 50 years. But any proportion of the legal and professional costs that relate to the payment of a premium on the renewal of a lease are not deductible.

How do you value a leasehold property?

The valuation of leasehold is the discounted value of the net cash flow as it would with a freehold valuation. However the major difference is that the net income stream of the leasehold is finite (see Figure 1 – ten years). It is useful to consider the nature of a leasehold investment.

How does leasehold affect value?

Why does leasehold property lose value? If a property has less than 80 years left before its lease expires it is known as a ‘short leasehold’. In becoming a short lease property your home may lose 10-20% of its value, while premiums are also likely to rise dramatically.

Is it hard to sell a leasehold property?

Selling a leasehold property can be a bit more complicated than selling a freehold property. However, usually you will only need to collect more pieces of paperwork and do some more planning. If you’re properly prepared, selling a leasehold property can be quite straightforward.

Should I avoid leasehold property?

In summary, it is acceptable to purchase a leasehold home, as long as you are careful with what you are buying. In most cases, the long length of the lease, combined with your legal right to renew your lease, will mean that your interest in the property is satisfactory.

Why you should not buy leasehold?

Some of the cons of leasehold include: You might need to pay an annual ground rent or service charge, both of which could be expensive. You may not be allowed to carry out major refurbishment or extension works. Sometimes this will require consent from the freeholder, and there’s no guarantee they’ll say yes.

Is it harder to sell a leasehold property?

Selling a leasehold property can be a bit more complicated than selling a freehold property. However, usually you will only need to collect more pieces of paperwork and do some more planning. If you’re properly prepared, selling a leasehold property can be quite straightforward.

Why is a 99 year lease not 100?

The development authority of a particular area provides land development rights to developers and sells properties for a lease of 99 years. This means that anyone who purchases a residential or commercial property will own it only for a period of 99 years, after which the ownership is given back to the landowner.

Is a 999 year lease as good as freehold?

How long can a lease be? Newly-created leases can be anything from 99 or 125 years to 999 years. A 999 year lease is effectively as good as freehold, and there can even be some advantages to owning some properties this way, rather than under freehold (see below).

What is the longest lease in history?

So, what is the longest lease in existence? That honour goes to Guinness. In 1759, at the age of 34, Arthur Guinness signed a 9,000-year lease for the St James’s Gate Brewery, Dublin, at an annual rent of £45.