- Higher interest rates could trigger a slowdown in consumer spending.

- Goldman Sachs projects U.S. GDP for the end of 2022 to expand by a mere 1.75%.

- Additionally, economists at Goldman Sachs Group estimate up to a 35% chance that the economy will go into recession, which would impact the housing market.

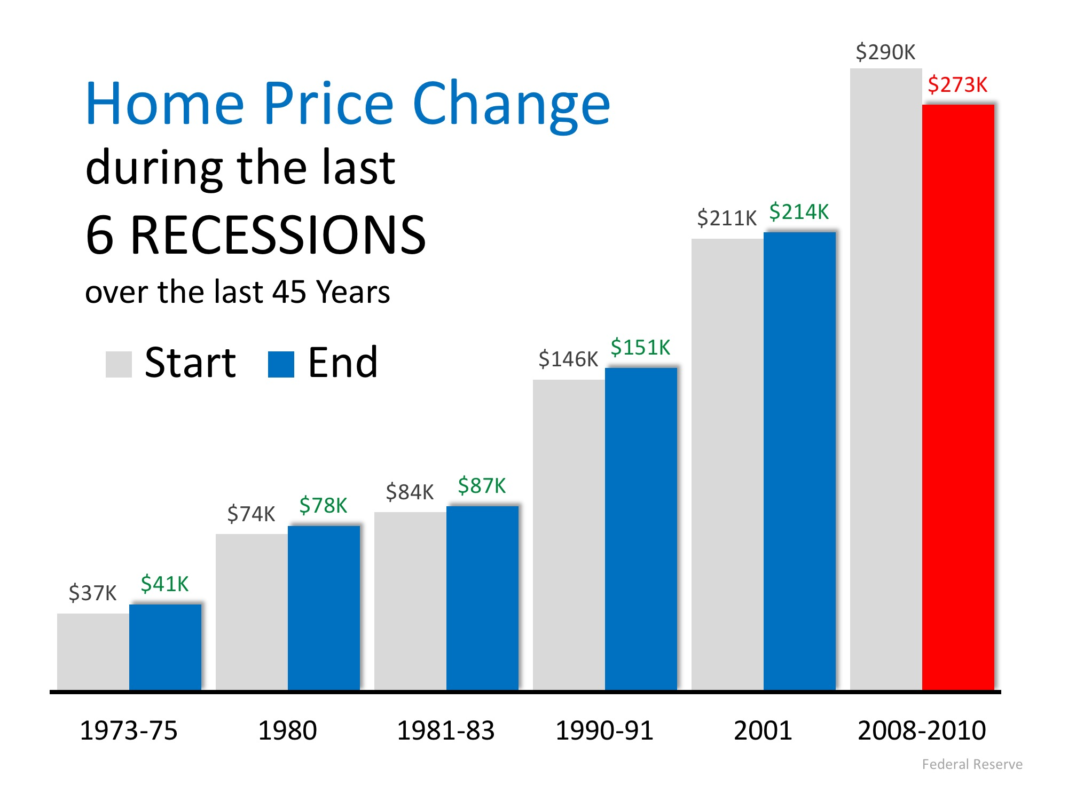

Moreover, Should I sell my house before a recession? So when is the best time to sell a house? This is where it gets tricky because oftentimes the very best time to sell a house is before a recession. Home values can fall during a recession, but they’re usually at a peak right before the recession hits, so if you can, it’s smart to sell high and buy low.

Will house prices go down in 2023?

House prices will also decline as affordability constraints bite, but tight markets and a lack of forced sellers means we expect the drop to be relatively modest, with annual growth falling to -5% by mid-2023,” wrote Capital Economics in its latest outlook.

Likewise, Will there be a recession in 2023? The U.S. economy will likely tip into recession during the first quarter of 2023 and shrink 0.4% for the full year as the combination of high inflation and tightening monetary policy bedevils consumers and businesses, Fannie Mae economists said.

Should I buy a house during inflation? In inflationary times, it’s especially important to invest your money in an asset that traditionally holds its value or grows in value. Historically, home price appreciation outperformed inflation in most decades going all the way back to the ’70s, making home ownership a historically strong hedge against inflation.

Is it a buyers or sellers market 2022?

What does it all mean for 2022? The property market is expected to remain a buyers’ market for a while yet, as banks continue to compete for customers, meaning they offer better home loan deals. But a slow down of movement in the market has been predicted.

Will mortgage rates go down in 2024?

A Bloomberg poll of economists in mid-June found they expect the Federal Reserve to cut interest rates in late 2024. In the meantime, while today’s rates may be a substantial increase from 2020’s rate environment, rates are still fairly low compared to prior historical levels.

Are we heading for a recession in 2022?

Kelly said the economy could slip into a technical recession — defined as two consecutive quarters of negative growth — as soon as the end of the second quarter of 2022. Analysts will be closely watching the Bureau of Economic Analysis on July 28 for early estimates on that.

Is a recession coming in 2023?

The U.S. economy will likely tip into recession during the first quarter of 2023 and shrink 0.4% for the full year as the combination of high inflation and tightening monetary policy bedevils consumers and businesses, Fannie Mae economists said.

How do you prepare for a recession in 2022?

Whether a recession is near, or a bit further away, here’s what you can do to prepare.

- Update your resume. The labor market has been hot for job seekers, but that will change if a recession hits. …

- Reduce expenses. …

- Bulk up your emergency fund. …

- Pay down debt. …

- Stay invested.

What should you invest in during a recession?

During a recession, some sectors of the economy tend to outperform others as consumer needs shift.

…

Sectors that tend to perform well during recessions

- Communication services.

- Consumer discretionary.

- Consumer staples.

- Energy.

- Financials.

- Health care.

- Industrials.

- Information technology.