In general, it is low-income families who pay the most taxes compared to the wealthy

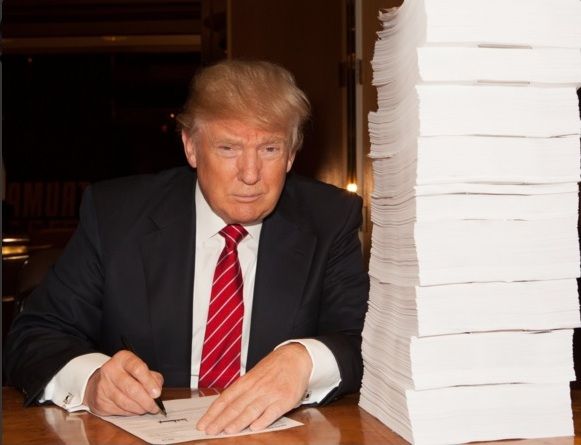

Following the New York Times report on President Trump’s tax returns showing he only paid a meager $ 750 between 2016 and 2017, a New American Economy (NAE) study revealed that immigrants paid $ 458.7 billion in taxes. in 2018.

Meanwhile, undocumented immigrants paid $ 31.9 billion that same year, according to data from (NAE).

“In light of recent news, it is worth reiterating that immigrants who are frequently targeted by this administration, including the undocumented, pay more than $ 450 billion in taxes each year.“Said Andrew Lim, director of Quantitative Research for the New American Economy.

“County by county and state by state, immigrant households help power our economy as workers, consumers and taxpayers,” he added.

In California, 26.8% of the population are immigrants who in 2018 paid $ 119.78 million in taxes.

In the Los Angeles metropolitan area, there are 4.3 million immigrants and they constitute 32.9% of the population. In 2018 they paid $ 41.9 million in taxes.

“The president sold himself to the American people as a business genius, with his companies always making incredible profit margins. Now what a good part of the American public suspected is being verified: Donald Trump is a failed businessman whose investments have lost money and he owes hundreds of millions of dollars to the banks and the government, ”said Juan José Gutiérrez, director of the Coalition of Plenary Rights for Immigrants.

“Donald Trump is going down in history as the president of the United States who most consistently lied to the American people. In the Latino community he is now known, referred to and will undoubtedly be remembered by all as the “liar in chief” in our great nation, “he added.

Cudahy city councilman and economist and chartered accountant Jack Guerrero said most of the critical response has focused on the $ 750 in taxes allegedly paid during each of the first two years of Trump’s presidency.

However, it considered that the millions of dollars in losses during previous years, against which subsequent obligations can be offset, are ignored.

“Loss carryforward provisions in the tax code allow a person to spread current losses to subsequent years to offset future tax bills”.

And note that separately, the figure identified in the press does not include taxes paid at the state and local level, employee-related taxes, and other business levies contributed during the same years.

Furthermore, it emphasizes that the aforementioned figure does not consider that President Trump has voluntarily returned $ 1.6 million in compensation to the United States Treasury over the course of four years.

In the end, he remarks that the proper evaluation of President Trump’s tax contributions must take into account advance tax payments from previous years, and any carry-over losses that President Trump is legally entitled to adjust to in his subsequent accounts.

“If one has a problem with the intricate structure of deductions, credits, provisions and incentives (for and against) of certain business practices and behaviors of the tax code, it would be more appropriate to direct their frustration towards the tax regime.“Guerrero said.

However, it is not only President Trump who pays very little taxes in the country, but in general the wealthiest are the least reported with Uncle Sam.

The organization California Budget and Policy Center established in the study “Who pays taxes in California”From 2015, which contrary to the repeated claim that high-income Californians pay an unfair amount of taxes, it is actually California’s low-income families who pay the majority of their income in state and local taxes.

“Legislators could take specific steps to reduce dependence on California’s state and local tax system for low-income families and promote economic security,” they advised at the time.

The report indicates that California’s state and local tax system asks disproportionately more from low-income families compared to higher-income families.

Add that One-fifth of non-elderly families in California, with a median annual income of $ 13,900, spend approximately 10.5% of their income on state and local taxes, compared to the richest 1% of families, with a average annual income of $ 2.0 million who spend an estimated 8.7% of their income on state and local taxes ”.