[Article partenaire] On the occasion of the deconfinement, the tax expertise firm LCT World, member of the Transatlantic Tax group joined forces with Patrick Bourbon, CFA, CFP, financial advisor, wealth engineer and personal chief financial officer, to offer you a guide to the taxation for expatriates in the United States.

Your wealth is made up of all your property acquired by yourself, or inherited from your parents, and involves management on several levels. A very important aspect of this management is taxation. Often feared wrongly, the taxes that arise from the value of your property, such as the property tax, for example, in fact constitute your contribution to the smooth running of your city or country of residence.

The Importance of Using a Tax Advisor

The tax specialist is a professional who helps you understand how the taxation and tax administration of your country or city of residence works. Also, he gives you sound advice and / or takes charge of all the tax management of your assets.

Your taxation is unique

As a taxpayer, you need to understand that your tax record is like no other. Your tax specialist will therefore study your case in order to find the most advantageous way for you to declare and pay your taxes. Specialists like Patrick Bourbon CFA, CFP, engineer and consultant international wealth management, which assists its customers in the management of their financial assets, supports them and advise on the difficulties facing French people living in the United States, in this case speak of tax optimization.

Tax optimization is not tax evasion

Please note that tax evasion is fraud! Be careful, when we talk to you about “niche”: this consists of finding tips to avoid the tax system to which we belong. Thus, the taxpayer who practices tax evasion refuses to contribute to the smooth running of society.

Tax optimization, on the other hand, involves finding the fairest amount of tax you need to pay for your situation. Indeed, there are advantages in tax legislation related to your particular case, but which you do not control. The tax specialist will therefore do your research and highlight the tax benefits to which you are effectively entitled.

Income from your work

Regarding the income from your work, called “earned income” in the United States, you should know that they are heavily taxed. In this category, we find your salary, your retirement, or even your indemnities received.

This income can be taxed up to 50%. It is at this point that your tax specialist will make a multidisciplinary, rigorous and global analysis of your assets (investments, taxation, pensions, financing, education, insurance, inheritance, real estate, cash flow, etc.). In the strategy of developing your wealth, you therefore understand that the income from your employment should not be the majority in the total statement of your resources.

You must therefore save to invest to the maximum, if not a large part, almost 50% of your income will be taken as taxes. The tax specialists at LCT WORLD can help you diversify your sources of income under the supervision of Patrick Bourbon.

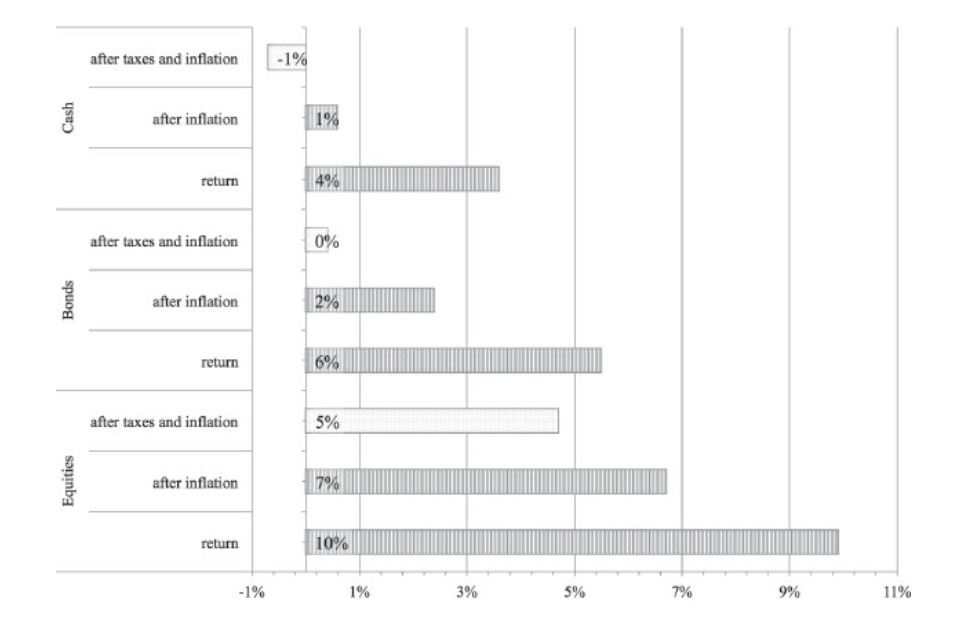

The impact of your investments

These benefits come from your various investments, particularly in stocks, bonds, commodities or even real estate. Thus, the income from your investments is dividends in the case of stocks, interest or coupons in the case of bonds. All share sales are subject to profit or loss rules. Short-term gains, which are sales of investments held for less than a year, are taxed as “ordinary dividends” (your highest tax bracket). For long-term earnings of more than a year, the tax rate will be capped from 0 to 23% depending on the tax rates applicable on an individual’s income tax return (with a new peak of 37% for the federal government).

If your tax bracket is 10%, the long-term capital gains tax is reduced to 0%. All short-term and long-term losses will offset capital gains and will be subject to a loss deduction limit of up to $ 3,000 per year against other income. Excess losses can be carried over to tax returns future years.

Your investments in times of crisis

For Patrick Bourbon, the best tactic to adopt for an investor in times of crisis is clear: you have to stay invested.

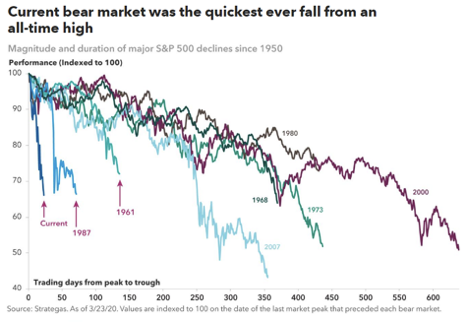

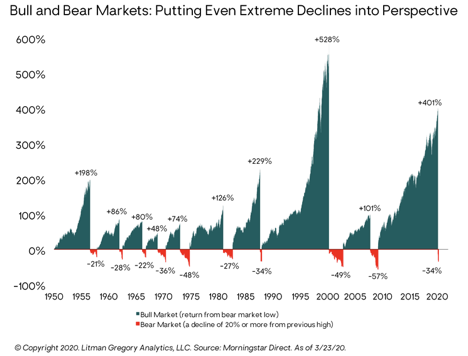

The fall of the stock market in March was very rapid. Many investors, seized with panic, decided to sell their shares quickly. However, historically, the best strategy for not losing money is, on the contrary, to remain invested in the market while waiting for the recovery in value of the shares.

After the historic declines, stocks are still rising:

A good wealth optimization strategy will thus be combined with the tax strategy of do not sell during a crisis (except for potential tax loss harvesting). Also, in general, it is wise to keep your property in your heritage as long as possible.

Indeed, it is during the realization of a capital gain that you are most heavily taxed. On the other hand, if you have acquired and kept an investment property for a period longer than twelve months, the tax on your income from this property is minimized.

The American tax administration favors those who keep their investments.

International legacies

Taxation of international successions has improved significantly in recent years. A European regulation on the subject was adopted on July 4, 2012, which entered into force on August 17, 2015. However, note that if the transmission or reception of goods from an inheritance has been simplified, you must always use a specialist (“cross borders tax planning”) to find out which taxation, which country, applies to each property. Again, it is important to know how to structure your wealth in this case. It is not enough to simply create an LLC or / SCI and put your property in it.

Avoid overly enticing proposals

In terms of wealth and taxation, it is important to choose the professional you trust. No matter how attractive the offers you find online, be cautious and avoid “crooked” advisers.

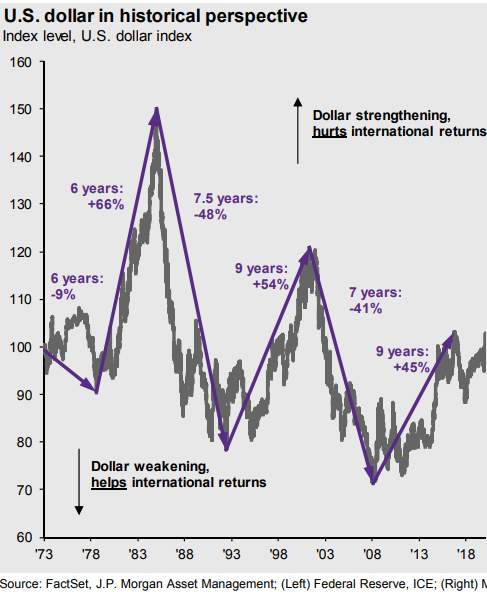

Returns above the market average are an index to be noted. So watch out for yield proposals of 3% to 5% each year. The presentation of the product is also to be taken into account. If you invest for example in a financial product of an American insurance company (which generates a lot of commissions to the seller / broker), then the assets are invested in dollars. But if your retirement is in Europe, you need euros. During certain periods, the dollar can lose 50% of its value against the euro and negatively impact your investment.

If you would like to know more, visit the Bourbon Financial Management and Transatlantic Tax websites.

—————-

Note: “partner articles” are not articles of the French Morning editorial team. They are provided by or written to the order of an advertiser who determines their content.

![[Vidéo] Real estate: buying in New York in 2021](https://californialines.com/wp-content/uploads/2021/01/Video-Real-estate-buying-in-New-York-in-2021-218x150.jpg)