- No.

- Paying rent does not build credit ordinarily, but it is possible to build credit by arranging to have rent payments reported to the credit bureaus each month.

Moreover, What are the risks of co signing a lease? As a cosigner on a lease, you’re not only helping someone out, you’re taking on a ton of risk. For instance, if the lease holder doesn’t make their payments on time, it will negatively affect your credit report and credit score.

What is a good credit score?

Although ranges vary depending on the credit scoring model, generally credit scores from 580 to 669 are considered fair; 670 to 739 are considered good; 740 to 799 are considered very good; and 800 and up are considered excellent.

Likewise, What is the fastest way to build your credit? 14 Tips on How to Build Credit Fast

- Request Your Free Credit Reports. …

- Verify the Contents of Your Credit Reports. …

- File a Credit Report Dispute If Errors Are Present. …

- Pay Your Bills on Time — Every Time. …

- Become an Authorized User on a Credit Card. …

- Pay Off Debt and Accounts-in-collections Quickly.

What kind of bills build credit? What Bills Help Build Credit?

- Rent Payments. Before property management platforms, renters were unable to report rent payments to credit bureaus to build their credit health. …

- Utility Bills. …

- Auto Loan Payments. …

- Student Loan Payments. …

- Credit Card Payments. …

- Medical Bills.

How long is a co-signer responsible?

As a general rule, unlike so many things in life, co-signing is pretty much forever. In the case of a lease, this means that the co-signer is responsible for the lease for the duration of the agreement, whether it’s a six-month lease, a yearlong lease or for some other period.

How do I protect myself as a cosigner?

Here are 10 ways to protect yourself when co-signing.

- Act like a bank. …

- Review the agreement together. …

- Be the primary account holder. …

- Collateralize the deal. …

- Create your own contract. …

- Set up alerts. …

- Check in, respectfully. …

- Insure your assets.

Should you cosign a lease?

When it makes sense to co-sign a lease. There are certain times when it makes sense to co-sign a lease: If you are able and willing to make the rent payments in the event your friend or family member cannot. If your friend or family member has a proven, reliable track record with money.

Can I get out of a lease I just signed Texas?

According to Section 91.001 of the Texas Property Code, a month-to-month lease may be ended by either the tenant or the landlord. Once they notify the other party, the tenancy ends on whichever of the following is later: The day stated in the notice; or.

Can a landlord break a lease?

A landlord can break a lease for two reasons—a tenant’s lease violation or an early termination clause in the agreement. For example, the landlord can evict a tenant for unpaid rent or breaking another rental lease clause. Also, a landlord can end the lease to sell, renovate, or move into the rental property.

How much does it cost to break a lease in Texas?

As a rule, the Texas Apartment Association typically recommends landlords charge 85% of a month’s rent to cover early lease termination expenses. In extreme circumstances, a landlord may sue a former delinquent tenant for past rent. Most of these cases are heard in small claims court with the maximum claim of $10,000.

How do I break a lease without penalty in Texas?

Figure out if you can break your lease under Texas law According to federal and state law, you can automatically terminate your lease if: You are entering active military duty. Your landlord has refused to make a major repair and your rental has become uninhabitable. Your landlord has cut off your utilities.

What happens if you break a lease?

As a result, breaking a lease usually comes with a fine. Sometimes the fine is equal to one or two month’s rent. Other times, you’re faced with the financial burden of having to cover the rent for the remainder of your lease term, regardless of whether you’re actually living in your apartment or not.

Can a tenant leave early?

You can end a fixed term tenancy early if you either: use a break clause in your contract. negotiate a surrender with your landlord.

What is the minimum notice a landlord can give?

Minimum notice periods 1 month if your rent is due monthly. 4 weeks if your rent is due weekly.

Can a landlord let themselves into your house?

You are paying rent to the landlord for exclusive use as the property as your home and as such you have the right to decide who enters it and when. If a landlord enters your home without permission they are, technically, trespassing, unless they have a court order to allow them otherwise.

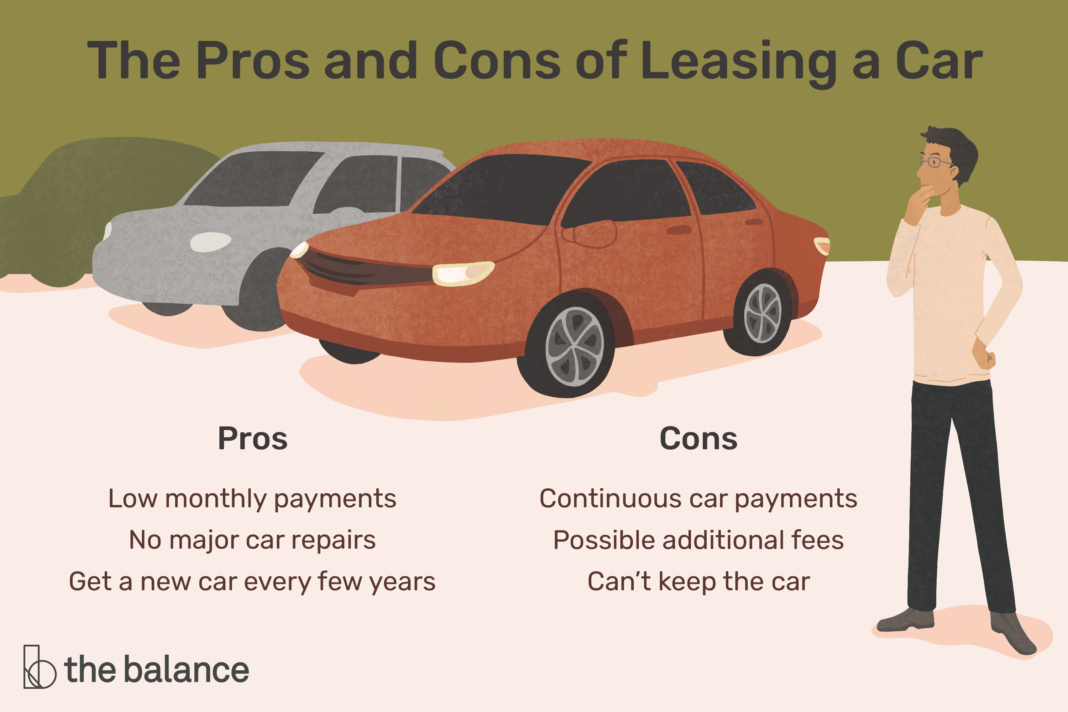

What are the disadvantages of a lease?

Disadvantages

- No equity/ownership in the vehicle.

- Potential early termination liability.

- Potential end-of-lease costs like excess wear and tear and additional.

- Mileage charge.

What are the disadvantages of a month-to-month lease?

Cons of Renting Month-to-Month The potential for lease termination is constantly present if you rent on a month-to-month basis. Your landlord just needs to give you between 30 to 60 days notice, depending on the reason for ending the lease. This can put you in a precarious position to have to find a new place quickly.

Is it better to lease or finance?

The monthly payments on a lease are usually lower than monthly finance payments if you bought the same car. With a lease, you’re paying to drive the car, not to buy it. That means you’re paying for the car’s expected depreciation — or loss of value — during the lease period, plus a rent charge, taxes, and fees.

What is the lease payment on a 50000 car?

To find out how much of your monthly payment will be interest, add the vehicle’s purchase price to its predicted residual value and then multiply that by the money factor. In the case of our $50,000 car: $50,000 + $30,000 = $80,000. $80,000 x 0.0028 = $224 per month, which is the finance fee.

How is leasing different from renting?

Leasing vs. The main difference between a lease and rent agreement is the period of time they cover. A rental agreement tends to cover a short term—usually 30 days—while a lease contract is applied to long periods—usually 12 months, although 6 and 18-month contracts are also common.

What is the most a landlord can raise rent?

According to the Tenant Protection Act of 2019, also known as AB 1482, landlords are allowed annual rent increases of 5% plus the percentage change in the cost of living (Consumer Price Index) per year, up to 10%.

What is the best lease length for an apartment?

One-year leases are by far and large the most popular length for leases. They’re good if you have high-quality tenants and an effective tenant screening process in place. In this case, year-long leases are good because it secures good tenants for a long period of time.

Is lease better than rent?

In leasing, you’ll have to pay a fixed amount ( it will be 40-50 times that of the rental amount). Additionally, if a particular company requires an asset throughout the year, then a lease is the best option. However, if there is no such demand, then renting is the best option.

Is leasing the same as renting?

Leasing vs. The main difference between a lease and rent agreement is the period of time they cover. A rental agreement tends to cover a short term—usually 30 days—while a lease contract is applied to long periods—usually 12 months, although 6 and 18-month contracts are also common.

What are the 3 types of rental agreements?

What are the types of rental agreements?

- A lease agreement.

- A license agreement.

- Long term lease.

- Commercial lease.

- Tenancy Agreement.

- Short-term lease.

What are the types of lease?

The three main types of leasing are finance leasing, operating leasing and contract hire.

- Finance leasing. …

- Operating leasing. …

- Contract hire.

Will we get lease amount back?

Of course yes, you will definitely get back the leased amount back after the completion of the time period but the landlord will not pay any interest in the deposited amount, he is liable to pay only the Principal amount.

What does full lease total mean?

A full-service lease is typically defined as a lease that has one, all-inclusive rental rate which includes both the base lease rate and the operating expenses (property taxes, insurance and common area maintenance) combined into one figure.

What are two types of leases?

The two most common types of leases are operating leases and financing leases (also called capital leases).

What is a lease for an apartment?

A lease deed is a written contract between the property owner and the tenant that carries all the terms and conditions. A lease deed is signed between the two parties at the time of renting of commercial property. A lease deed has to be registered, if the lease period is for more than 11 months.