For not having a social security number, even when they pay taxes, they are excluded

Monica and Adrián López are a couple with mixed immigration status that they have been filing their taxes together since they were married for three years, but because she is a US citizen; And he, an undocumented immigrant, will not receive the coronavirus economic stimulus package check.

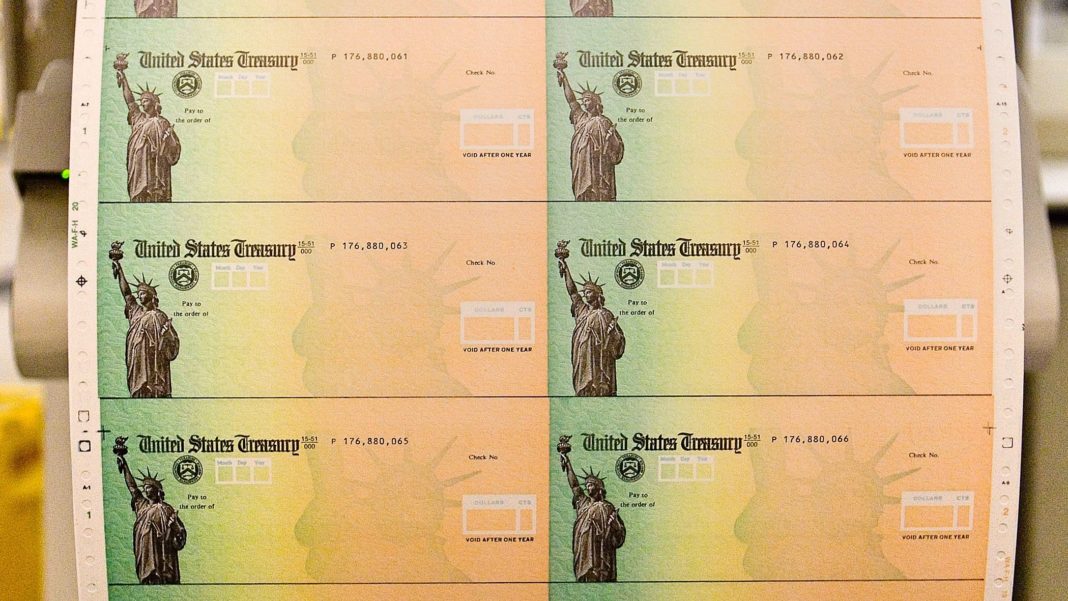

This $ 2 trillion economic rescue package, requires that both members of married couples filing jointly have valid social security numbers, creating a problem for families with mixed immigration status.

"It is very unfair that undocumented people like my husband who contribute to the United States economy and pay taxes using their ITIN – personal identification number – are not supported and excluded," said Monica, who was left out of this benefit. , at a time when millions of Americans receive the relief check in their bank accounts.

It is estimated that One million US citizens will not receive that $ 1,200 economic stimulus per adult, because their immigrant spouses do not have a Social Security Number (SSN).

Irma Treviño, spokesperson for the Tax Collection Service (IRS), stated that "when the spouses file your taxes Together, both must have valid SSNs to receive a payment."

But he said there is an exception to the rule, when either spouse is a member of the United States military, only one spouse needs to have a valid SSN to receive the benefit.

In addition, he indicated that married people have the option that one of them, who has valid social security, can make their tax return separately, and qualify for the stimulus check for the pandemic.

"It is not in our best interest for me to file my tax returns individually. It would not help us in the future when I apply for residency for my husband. Not reporting together can be a problem in the process to fix your immigration status, "said Monica.

Although she acknowledges that the economic stimulus would be very useful, especially since her husband has not worked in construction for a week, after being suspended due to a partner testing positive for the virus, they prefer not to take risks that could affect the request for home.

“We are trying to stay positive for our one and a half year old son. His arrival was a blessing. In this 2020, we expected a change because last year we did very badly. We lost our house in a fire. "

However, when hope reappeared for this couple, COVID-19 arrived. “I am barely winning. My husband is out of a job. You have to pay the debt of the house, the car, the student loans and the expenses of daily life, ”he lamented.

Francisco Moreno, director of the Council of Mexican Federations (COFEM), said that it is very unfair and sad that immigrants who pay taxes are not entitled to receive the benefit of economic stimulus, in times as difficult as those we are experiencing.

“They report their taxes and they are an essential part of our economy. How unfortunate! ”He noted.

And added that This exclusion from the economic relief package will greatly affect the Latino community, where there are many variants of couples with mixed immigration status.

The IRS spokeswoman said that the economic stimulus checks will be delivered throughout the year.

Closing of benefits

Nelson Vargas of the organization Consumer Action, recalled that this Friday is an important deadline for the IRS for certain beneficiaries of federal programs, to get faster the extra economic stimulus payments of $ 500 for their dependent children.

"The beneficiaries of Social Security programs and Railroad Retirement who did not have to file tax returns in 2018 and 2019, and who have children up to the age of 16, will have to visit the IRS non-filer tool and provide information on their dependents to receive the extra 500 for each dependent child ” .

He added that if they don't, they will automatically receive their $ 1,200 economic stimulus anyway, but to get the extra money for their children they will have to wait until next year when they file their 2020 taxes.

More detailed information in English and Spanish is in yesterday's IRS alert.

https://www.irs.gov/newsroom/ssa-rrb-recipients-with-eligible-children-need-to-act-by-wednesday-to-quickly-add-money-to-their-automatic-economic- impact-payment-irs-asks-for-help-in-the-plus-500-push